Mid-cap value mutual funds focus on stocks with low valuations and high dividend yields to generate consistent returns. Thus, investors with a value-oriented approach and a long-term investment horizon may consider – FLPSX and VMVIX. Currently, analysts project more than 10% upside potential in these two mutual funds over the next twelve months.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s delve deeper.

Fidelity Low-Priced Stock Fund (FLPSX)

The Fidelity Low-Priced Stock Fund primarily invests in stocks with lower share prices, offering potential diversification and opportunities for long-term capital appreciation. This fund focuses on undervalued stocks with growth potential.

As of today’s date, FLPSX has 720 holdings with total assets of over $25.2 billion. Interestingly, it has an impressive dividend yield of 1.67%. Also, FLPSX has generated a return of 6.7% over the past three months.

Overall, FLPSX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 720 stocks held, 222 have Buys, 489 have a Hold rating, and nine have a Sell rating. The average FLPSX price target of $64.67 implies a 47% upside potential from the current levels.

Vanguard Mid-Cap Value Index Fund Investor Shares (VMVIX)

The VMVIX mutual fund seeks to track the performance of the CRSP U.S. Mid Cap Value Index. This index includes mid-sized companies in the U.S. stock market that are considered undervalued. VMVIX provides investors with the opportunity to gain diversified exposure to a portfolio consisting of mid-cap value stocks, potentially leading to long-term capital appreciation.

The VMVIX has 194 holdings with total assets of $26.18 billion. Additionally, the fund has a stellar dividend yield of 2.33%, much above the sector average of 1.66%. The VMVIX fund has returned about 7% over the past three months.

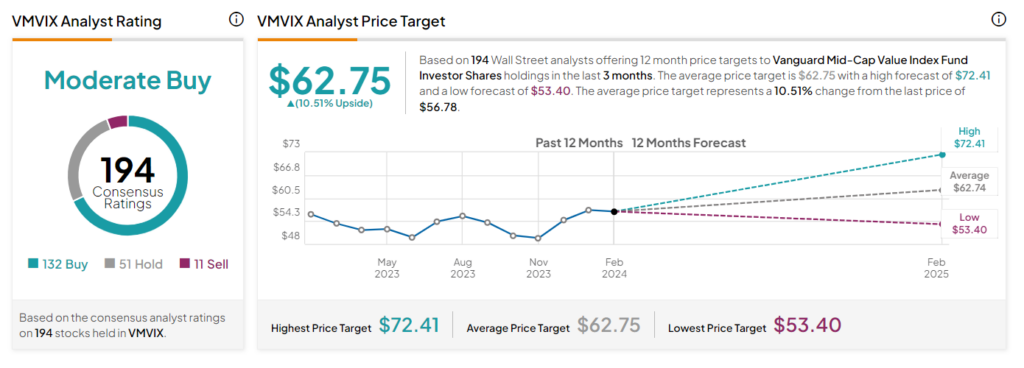

On TipRanks, VMVIX has a Moderate Buy consensus rating. This is based on 132 stocks with a Buy rating, 51 stocks with a Hold rating, and 11 with a Sell rating. The average VMVIX mutual fund price target of $62.75 implies a 10.51% upside potential from the current levels.

Concluding Note

With a focus on mid-cap companies, both FLPSX and VMVIX mutual funds offer a blend of potential growth and stability, making them a suitable option for investors seeking long-term capital appreciation. However, it would be prudent to conduct thorough research before investing in both of these mutual funds.