Investor concerns about the Russian war on Ukraine and consequent rising oil and commodity prices have caused recent excessive volatility in the stock market. In addition, inflation reached a 40-year high, exacerbating the persisting environment.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Furthermore, during its Federal Open Market Committee (FOMC) meeting this week, the U.S. Federal Reserve is expected to tighten its monetary policies. The Fed is anticipated to raise the rate from zero to a quarter percentage point. However, Chairman Jerome Powell may intervene more hawkishly down the line if the red-hot inflation continues unmitigated.

As the broader investment environment appears shaky, investors may be tempted to stay away from risk-on assets, like stocks, for now. However, volatility is unavoidable, and timing the market is tricky.

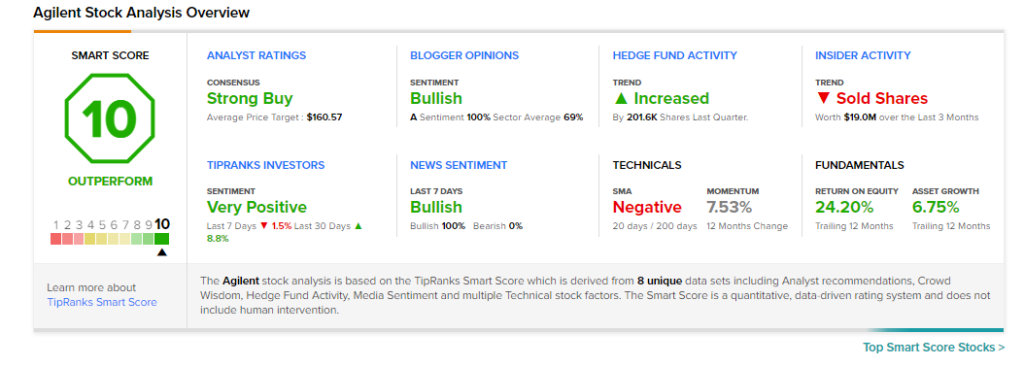

In such instances of excessive volatility, TipRanks’ Smart Score system can come in handy. The tool allows investors to understand a well-rounded macro snapshot on a firm.

The tool’s method includes a stock rating on a scale of one to ten, with ten being the best, based on eight key indicators. After looking at TipRanks’ Top Smart Score Stocks, let’s take a look at two stocks which received a “Perfect 10.”

Halliburton (HAL)

Halliburton Company, one of the world’s leading oilfield service providers, has received a “Perfect 10” over the last three days.

The company operates in the energy, industrial, and government sectors with a variety of equipment, maintenance, engineering, and construction services. The two key segments in which it works are Completion and Production, and Drilling and Evaluation.

In terms of financial performance, Halliburton posted strong fourth-quarter earnings in January. On a year-over-year basis, both revenues and profits per share increased. Revenues increased 32.1% year-over-year to $4.27 billion, while adjusted earnings doubled to $0.36 per share, beating the Street’s estimate of $0.34 per share.

These impressive results bolstered the company’s dividend-paying program. The company increased its quarterly dividend to $0.12 per share (annualized to $0.48 per share). Investor confidence is boosted in large part by the ongoing dividend hikes.

Furthermore, a majority of experts are optimistic about this firm. On TipRanks, Halliburton commands a Strong Buy analyst rating consensus based on 10 Buys and three Holds. The average HAL price target is $34.38, representing a 5.45% downside potential.

Encouragingly, the stock has generated a lot of excitement among investors. Of investors holding portfolios on TipRanks, many maintain a positive outlook on HAL. According to the statistics, 23.6% of these investors boosted their HAL stock holdings in the last 30 days.

Agilent (A)

Next up is Agilent Technologies, Inc., a developer and manufacturer of analytical instruments for laboratory workflows which has received a “Perfect 10” rating over the past three days.

The company has been introducing new and improved items on a regular basis, which has boosted its consumer loyalty and market share. Agilent has been generating robust results over the last three quarters, owing to its strength in end-markets and its solid execution.

The company’s financial results for the fiscal first quarter of 2022 were revealed last month. Its quarterly sales increased 8% year-over-year to $1.67 billion, while adjusted profit increased 14% to $1.21 per share.

Analysts are upbeat about this stock, with six Buy ratings and one Hold rating. The shares are priced at $127.58, and the average Agilent price target of $160.57 implies around a 25.9% potential upside from that level.

In addition, investors have been enthusiastic about the stock. It’s worth mentioning that investors holding portfolios on TipRanks maintain a positive outlook on Agilent stock. The data shows that 8.8% of these investors have increased their holdings in A stock over the last 30 days.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure