The current macroeconomic environment is plagued by several headwinds, including the impact of the Russia-Ukraine conflict, the Fed’s aggressive monetary policy to curb rising inflation, labor challenges, supply-demand imbalance, fears of an impending recession, and many more.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In such a gloomy scenario, rising volatility in markets has spooked investors’ risk-taking appetites. Though a modest rally has been visible since late May, volatility still prevails, pushing the U.S. to the edge of a bear market.

Overall, the market has experienced a downtrend so far this year, with the S&P 500 (SPX) declining more than 14%.

Though every investor uses his own due diligence to add stock to his portfolio, making informed investment decisions in such tough times could reap potential returns.

Here comes the need for TipRanks’ helpful tools. TipRanks’ Insiders’ Hot Stocks tool assists investors in identifying stocks that have seen insider trading activity recently.

By using this tool, let’s dig into the prospects of two stocks — Cullinan Oncology and Rapid Micro Biosystems — that indicate a Positive or Very Positive insider confidence signal.

Cullinan Oncology, Inc. (CGEM)

Cullinan Management, a biopharmaceutical company, focuses on developing a diversified pipeline of targeted oncology and immuno-oncology therapies for patients with cancer.

Encouragingly, in the recent earnings report, Cullinan CEO Nadim Ahmed commented, “…we are in an even stronger financial position to continue advancing our strategically built pipeline of diversified assets, each with the potential to be the first or best in their class. We ended the first quarter of 2022 with approximately $410 million in cash and investments, which, when added to proceeds from the Taiho deal, aggregates to $685 million, and extends our cash runway through 2026.”

Nadim Ahmed, the company’s CEO, purchased 8,090 shares worth $100,320 earlier this week. In addition, the investment firm Bvf Partners LP Il (which owns more than 10% of the company) purchased 751,400 shares worth $8.26 million.

Moreover, the TipRanks Insiders page indicates a Positive Insider Confidence Signal, which is based on five informative insider transactions by five unique investors over the last three months, reflecting more Buys than Sells in this period. Furthermore, corporate insiders have purchased shares worth $17.3 million in the past three months.

As a result, a strong upside to the stock can be expected on insiders’ optimism, who normally are prospective buyers.

Last week, SVB Securities analyst Andrew Berens maintained a Buy rating on Cullinan with a price target of $25 (84.5% upside potential), while another analyst, Edward White, at H.C. Wainwright firm reiterated a Buy rating. Both together lead to a consensus rating of Moderate Buy.

Rapid Micro Biosystems, Inc. (RPID)

Rapid Micro Biosystems is an innovative life sciences technology company. It provides solutions to help in the manufacturing and safe release of healthcare products, including biologics, vaccines, cell and gene therapies, and sterile injectables.

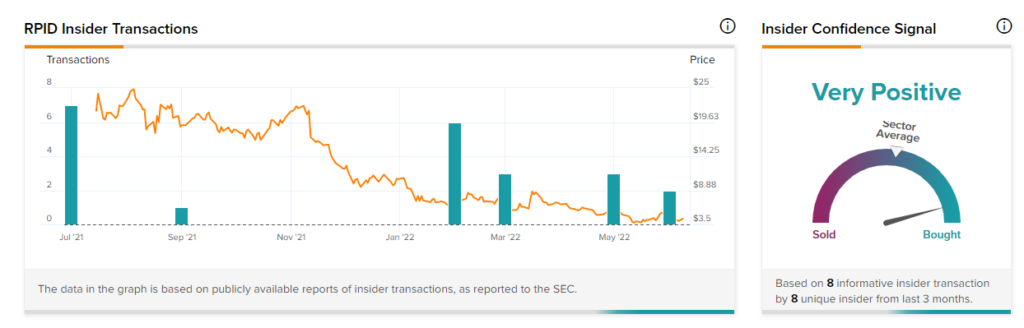

Corporate Insiders are very positive about the stock. According to the TipRanks Insiders page, corporate insiders have bought shares worth $1.4 million in the past three months.

Interestingly, per SEC (Securities and Exchange Commission) filings and TipRanks’ Insider Trading Activity tool, over the last month, Kennedy Lewis Management LP purchased 275,120 shares of RPID valued at $1.24 million. It includes this week’s purchase of 60,100 shares for $0.28 million.

Last month, RPID President and CEO Robert G. Spignesi also bought 10,000 shares of RPID valued at $37,950. Thus, an uptrend in price could be foreseen for the RPID stock.

The stock has picked up ratings from two analysts in the past three months. Morgan Stanley analyst Tejas Savant reiterated a Hold rating and a price target of $8 (81.41% upside potential) on RPID. Meanwhile, J.P. Morgan analyst reduced the price target to $10 (126.76% upside potential) from $15 but maintained a Buy rating on the stock.

Ratings by both analysts lead the stock to a Moderate Buy, with an average Rapid Micro Biosystems price target of $9, implying 104.08% upside potential to current levels.

Bottom-Line

We all know that insiders have access to more information than investors. Though investors conduct their own due diligence before investing in any stock, expert opinions and actions help them make judicious decisions.

Interestingly, TipRanks’ insider transactions reflect commendable annualized returns of 11.32% in the past 13 years and 19.66% by top-ranked insiders.

Read full Disclosure