Mutual funds provide higher liquidity than individual stocks and enable investors to quickly diversify their portfolios. Investors with long-term horizons could consider – FCGSX and PRCOX – two equity mutual funds with over 10% upside potential.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Let’s take a closer look at the two funds.

Fidelity Series Growth Company Fund (FCGSX)

Fidelity Series Growth Company Fund is an open-end equity mutual fund. The fund pursues a global investment strategy focused on growth stocks across diverse market capitalizations. It manages a portfolio of growth stocks benchmarked against the Russell 3000 Growth Index.

On TipRanks, the FCGSX has a Smart Score of eight, meaning it has the potential to outperform market expectations. As of today’s date, FCGSX has 361 holdings with total assets of over $14 billion. Interestingly, FCGSX has generated a return of 34.5% over the past year.

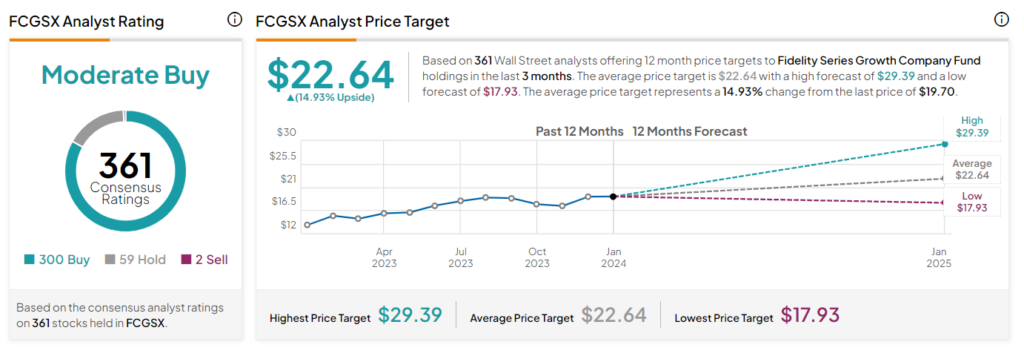

Overall, FCGSX has a Moderate Buy consensus rating. This is based on the weighted average consensus rating of each stock held in the portfolio. Of the 361 stocks held, 300 have Buys, 59 have a Hold rating, and two have a Sell rating. The average FCGSX price target of $22.64 implies a 14.9% upside potential from the current levels.

T. Rowe Price U.S. Equity Research Fund (PRCOX)

The Fidelity Blue Chip Growth Fund is an open-end equity mutual fund that focuses on the stocks of U.S. companies operating across different sectors. The portfolio aims to outperform both the S&P 500 (SPX) and the Lipper Large-Cap Core Funds Index.

The PRCOX also has a Smart Score of eight, which indicates it has the potential to beat the market average. As of today’s date, PRCOX has 294 holdings with total assets of $10.2 billion. PRCOX has returned about 24% over the past year.

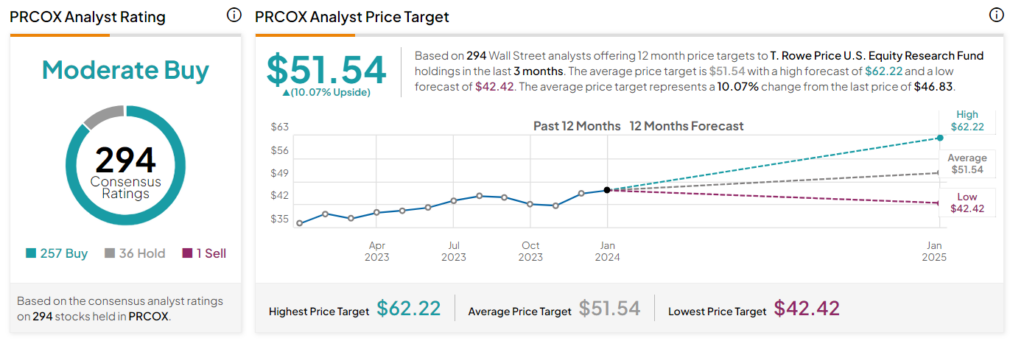

On TipRanks, PRCOX has a Moderate Buy consensus rating. This is based on 257 stocks with a Buy rating, 36 stocks with a Hold rating, and just one Sell. The average PRCOX mutual fund price target of $51.54 implies a 10.1% upside potential from the current levels.

Ending Note

The advantages of mutual funds, coupled with the projected upside potential of FCGSX and PRCOX, present enticing opportunities for investors. However, a prudent approach necessitates in-depth research before investing.