While commodity prices, including crude, have cooled off over the past year, Goldman Sachs maintains a bullish outlook. While Goldman expects a significant rally in commodities, the firm is bullish on Occidental Petroleum (NYSE:OXY) and ConocoPhillips (NYSE:COP) in the energy sector.

Goldman Sachs said that the demand for commodities has remained steady despite a weak macro environment. Meanwhile, investments in supply remain dry. This points to a major rally in commodity prices.

In a note to investors dated May 1, Goldman Sachs analyst Michele Della Vigna downgraded Exxon Mobil’s (NYSE:XOM) stock to Hold, citing its high valuation. However, the analyst sees “absolute value” in several companies in the energy space, including OXY and COP. Vigna also has a bullish long-term view of oil prices.

Emphasizing the E&Ps (Exploration & Production companies), Vigna reiterated a Buy on Occidental stock. The company’s robust free cash flows, focus on simplifying the corporate structure, strong upstream assets, and solid earnings growth potential from its chemical segment keep the analyst bullish on OXY stock.

As for COP, the analyst highlighted the company’s ability to return solid cash to its shareholders and the benefits from its long-term projects in the LNG (Liquefied Natural Gas) segment as the key catalyst behind the bullish outlook. Further, ConocoPhillips’ high ROCE (Return on Capital Employed) profile is positive.

While Goldman Sachs is upbeat about OXY and COP stocks, let’s look at analysts’ consensus ratings to gauge what’s on the horizon for these companies.

Is OXY a Buy, Sell, or Hold?

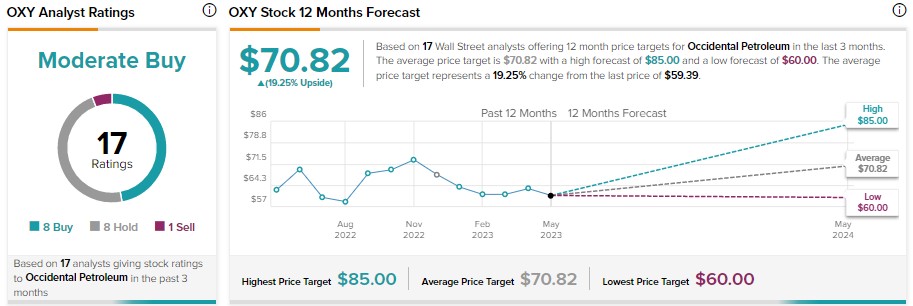

The economic uncertainty keeps Wall Street analysts cautiously optimistic about OXY stock. Occidental Petroleum has received eight Buy, eight Hold, and one Sell recommendations for a Moderate Buy consensus rating.

Further, analysts’ average price target of $70.82 implies 19.25% upside potential from current levels.

What’s the Prediction for COP Stock?

Along with Goldman Sachs, most Wall Street analysts covering COP stock have a bullish view. ConocoPhillips sports a Strong Buy consensus rating reflecting 12 Buy and three Hold recommendations.

Analysts’ average price target of $135 implies 29.83% upside potential.