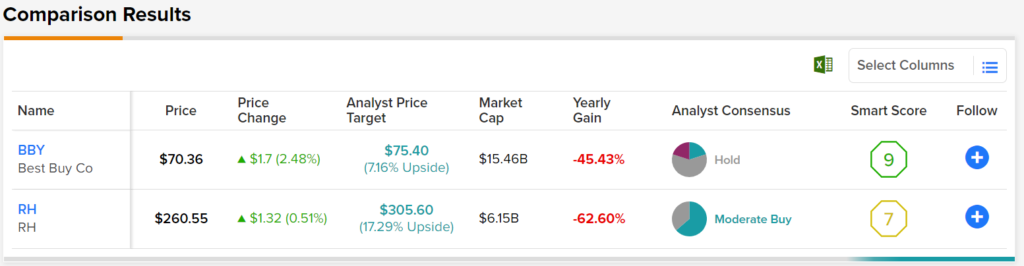

2022 has not been a kind year for many top retailers that flexed their muscles in 2020 and 2021. With Best Buy (NYSE:BBY) and RH (NYSE:RH) surrendering a massive amount of the gains enjoyed since their bottoms of 2020 over escalating recession fears, valuations are nothing short of compelling from a historical standpoint. We’ll use TipRanks’ Comparison Tool to look at two durable retailers that seem heavily oversold following one of the worst post-Fed reactions in more than a year.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Best Buy (BBY)

Best Buy is an electronics retailer down almost 50% from its all-time high. Undoubtedly, Best Buy has all the hottest tech that was in high demand (much of it was also in short supply) during the glory days of 2021. The so-called roaring 20s was cut short, and with a recession ahead, Best Buy has felt far more pain than your average retailer due to its highly-discretionary nature.

There just isn’t that much demand for 60-inch television sets or intriguing gadgets when rents rise. Though Best Buy and firms like it tend to experience amplified downside in the face of economic turmoil, a lot of such recession weakness may already be baked in.

Still, it may be too soon to jump in should a looming recession prove more severe. For reference, shares of BBY sunk 80% from its 2006 peak to its 2012 trough. Undoubtedly, the Great Recession wasn’t entirely to blame, but it did act as salt in the retailer’s wounds.

With a 50% haircut in the books, Best Buy seems to be at an uncomfortable midpoint. On the one hand, shares could get cut in half again should the looming downturn be as severe as the 2008 recession. On the other hand, a mild and short-lived recession could make Best Buy a great buy, perhaps even the best buy for value-conscious investors with a long-term mindset.

Best Buy’s economic sensitivity will be tough to overlook. That said, the stock is incredibly cheap at 9.2 times trailing earnings and 0.33 times sales. Indeed, investors have already braced for impact, the magnitude of which may be far more benign than expected.

Looking further out, management downgraded its 2025 targets. Sales are expected to hit $50 billion, down from $52.5 to $56.5 billion. The company is also looking to slash $1 billion in costs through various initiatives. With a lowered bar and a sound management team committed to improving amid challenging circumstances, pessimism may be overdone in BBY stock.

Despite such efforts, investors should expect amplified volatility (1.47 beta) versus the market. Best Buy is one of the firms that can’t escape the macroeconomic gravitational pull.

More recently, Best Buy pulled the curtain on its Upgrade+ program for Apple (NASDAQ:AAPL) Macbooks. The effort could help Best Buy ride on the resilient tech titan’s coattails as it continues to outdo its peers in the FAANG cohort. The Upgrade+ program could be a hit for Apple users close to a Best Buy.

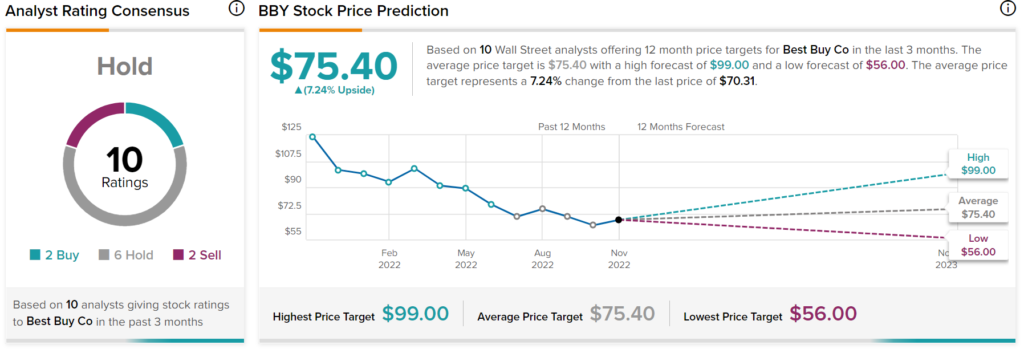

Is BBY a Good Stock to Buy Now?

Wall Street is quite mixed on Best Buy, with a “Hold” consensus rating. The average BBY stock price target of $75.40 implies a modest 7.24% return from current levels. Indeed, Best Buy shares are risky with questionable rewards in the face of a recession. While Best Buy stock seems dirt-cheap, only time will tell how cheap it is once the recession comes and goes.

RH (RH)

RH (Restoration Hardware) is a luxury furniture retailer that’s seen its shares decimated. The stock is down over 60% from its peak and back to where it was pre-pandemic. Though the 2021 gains were wiped out in such a painful fashion, I think RH can weather the storm.

The brand is quite robust among the affluent in the North American region. In time, I think RH can replicate its success in international markets. Though it will take many years for RH to get its growth edge back, I do believe the stock is approaching oversold territory.

Sure, a recession will crush demand, but expectations have already been lowered. With a strong brand and many growth levers to pull, the stock stands out as one that will deliver outsized results once the tides finally do turn.

Warren Buffett owns a sizeable stake in RH, likely because he viewed the firm as a wonderful company. Though, notably, the holding comprised less than 1% of Berkshire Hathaway’s (NYSE:BRK.A)(NYSE:BRK.B) portfolio.

At writing, shares trade at 11 times trailing earnings.

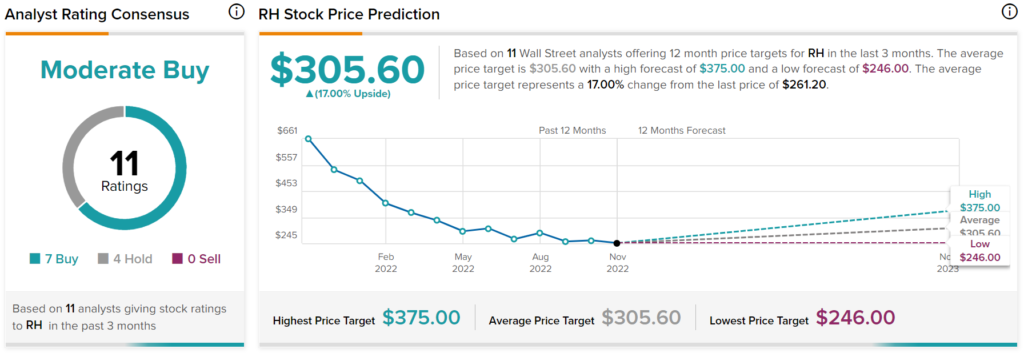

Is RH a Good Stock to Buy?

Turning to Wall Street, RH stock has a “Moderate Buy” consensus rating based on seven Buys and four Holds assigned in the past three months. The average RH stock price target is pinned at $305.60, which implies 17% upside from today’s levels.

Conclusion: Wall Street Prefers RH Stock

It’s hard to buy anything on the dip amid rising interest rates and a risk that we could be for a rockier-than-expected landing at the hands of a stubbornly-hawkish Federal Reserve. Indeed, fading consumer sentiment is the worst for discretionary retailers that sell nice-to-have products that aren’t in high demand when necessities continue to climb. Noonetheless, between the two hard-hit retailers, Wall Street prefers RH over BBY stock.