We live in the digital world, powered by a digital economy, and that means, long-term, we should look to the tech sector for strong stock results. Specifically, we need to be cognizant of AI.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

AI, or artificial intelligence, may have been prominent in Isaac Asimov’s science fiction novels – his famous ‘Robot’ novels come to mind – but in the real world, AI is here now. We don’t have Daneel Olivaw tapping on our shoulders yet, but AI gives us machines that can learn, and software that can process decisions in real time – and taken together, those facets may soon give us self-driving cars, that can sense their environment, avoid obstacles, and anticipate traffic.

The technology has less spectacular applications, too. AI programming has enhanced our communication systems and makes encryption more secure. Handwriting, speech, and facial recognition systems all depend on AI tech. On another level, AI also lies behind all the algorithms that determine what gets into our social media feeds.

So, let’s start looking for AI stocks that are primed for rapid growth. Tech always picks up reviews from Wall Street’s top analysts, and two 5-star stock watchers have tagged some AI-related companies for strong growth in the near future – we’re talking share price growth of 70% or better. Using the TipRanks platform, we’ve looked up the details on these stocks. Here’s the lowdown.

Talkspace (TALK)

If the last year and a half has shown us anything, it’s the value of telehealth companies. Digital networking has, in a way, brought back the doctor’s house call, allowing us to contact physicians and other medical professionals via video link, and meet a multitude of medical needs. Talkspace brings the telehealth model to the world of mental and behavioral health. The company offers individual therapy, couples therapy, adolescent therapy, and even psychiatric care and medication management via remote video link. Talkspace users can select from a list of providers, all licensed by the appropriate medical boards.

Using online video connections to link patients and doctors makes it easy to record the conversations – and Talkspace hit on a novel idea to bring AI tech to bear on the mental health sector. The company records therapy sessions, strips out all identifying data, and has machine learning and speech analysis algorithms analyze the content. The aim is to look for trends in the patient’s speech patterns and behavior that may provide a clue to the underlying mental health diagnosis, the proper path for treatment, or even if the patient may become a threat to himself or others. The system banks on the fact that, despite the variety of mental health diagnoses, patients frequently show similar use of language during a decompensation event. Talkspace uses AI to pick up on early signs of that, to trigger proper intervention.

Like many small- to mid-sized companies looking to enter the market, Talkspace has jumped on the SPAC bandwagon. SPAC – special purpose acquisition companies – are corporations formed for the express purpose of raising capital and then merging with a target company. The target is a private firm that wants to go public, but for whatever reason lacks the wherewithal to conduct an IPO. SPACs bring such companies onto the public stock markets.

Talkspace announced in January that it would be merging with Hudson Executive Investment Corporation, and on June 23 the transaction was completed and TALK shares started trading on the NASDAQ. The deal brought Talkspace approximately $250 million in new capital, and the company now boasts a market cap of $875 million. The share have slipped 35% since opening on the NASDAQ.

Covering the stock for SBVLeerink, 5-star analyst Stephanie Davis writes of Talkspace, its AI platform, and it attraction for investors: “…what we believe elevates TALK above its virtual behavioral health peers is its proprietary AI engine, which enhances both the clinician and user experience via improved engagement, connectivity, and outcomes. We believe the engine’s ability to create optimized, scaled, personalized care in the backdrop of broader clinician shortages has larger implications than even democratized access to behavioral healthcare. Despite our seeing just as much value in the AI engine as we do in the company’s core behavioral health platform, the company currently trades at a discount to both, creating a unique buying opportunity…”

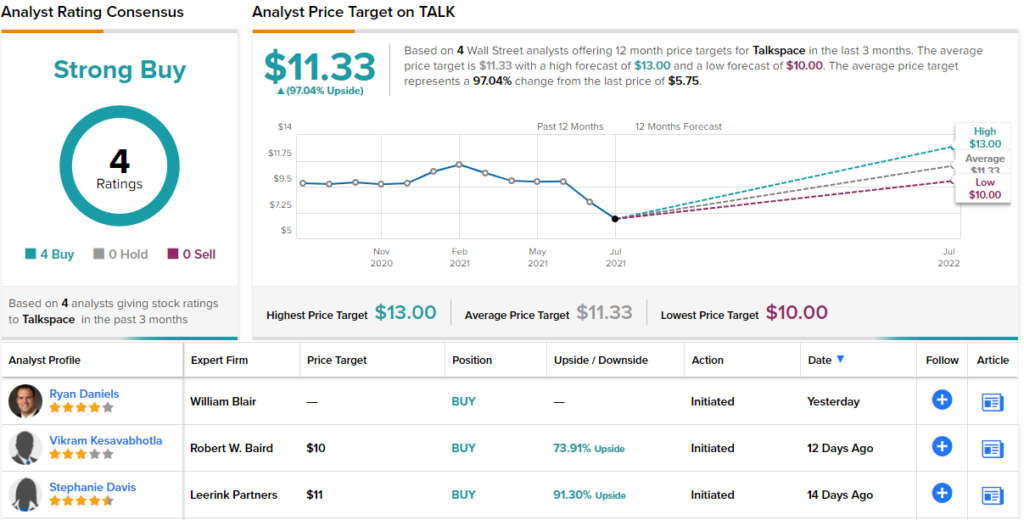

These comments back up Davis’ Outperform (i.e., Buy) rating, and her $11 price target suggests room for a 91% upside in the next 12 months. (To watch Davis’ track record, click here.)

While Talkspace has not been a public company for long, it has already acquired a unanimous Strong Buy consensus rating, based on 4 positive analyst reviews. The shares are currently trading for $5.75 and their $11.33 average price target implies a one-year upside of 97%. (See Talkspace’s stock analysis at TipRanks.)

Revolution Acceleration Acquisition (RAAC)

For the next stock on our list, we’ll look at a SPAC company. Revolution Acceleration formed with the purpose of targeting an AI company – and it has found an interesting target. RAAC is in the final stages of merging with Berkshire Grey, Inc., a maker of AI-powered warehouse and stock picking robot systems. The SPAC merger will produce a combined entity with an estimated value of $2.7 billion, and will provide Berkshire with approximately $413 million in new cash. The transaction is expected to close later this month.

Berkshire uses AI technology to create a class of warehousing robots capable of meeting the crunch of a growing labor shortage affecting major companies like Amazon (AMZN), Walmart (WMT), and FedEx (FDX). Berkshire calls its automatons ‘intelligent enterprise robots,’ and notes several immediate advantages that they can provide: improved warehouse throughput, with up to 70% picking cost reduction; increased speed, especially in the processing of millions of SKU numbers, permitting greater warehouse efficiency and faster order deliveries; maximum return on investment, as the robot system will pay for itself through higher mission-critical performance.

All of this is made possible by AI tech, and has immediate applications to the retail, grocery, and e-commerce sectors.

Heading into the SPAC merger completion, Berkshire Grey has reported several gains in key business metrics. We are only in mid-July, and the company has already contracted for 94% of its 2021 revenue forecast. Strong growth in the grocery and parcel verticals have pushed total orders up, and the company reported $114 million in new orders since the end of 2020. Also in the last six months, Berkshire’s business backlog, of orders to fill, has increased from $70 million to $95 million. And, the company has signed on to 4 new business partnerships.

Greg Palm, of Craig-Hallum, is impressed with Berkshire and sees plenty of investor opportunity in the coming SPAC merger. He writes, “Berkshire Grey has emerged as a leading robotics company that fully integrates hardware, software and AI into something it calls ‘Intelligent Enterprise Robotics.’ This product portfolio offers customers a comprehensive solution that includes robotic picking, mobility, cloud-based monitoring and analytics and service. As a result, we view Berkshire Grey as a key enabler that allows customers to better compete in this ever-changing environment…. With labor trends worsening and e-commerce demand accelerating, warehouse automation is at an inflection point…. We estimate that only 5% of warehouses are automated (the vast majority still utilize manual labor), creating a significant opportunity for companies like Berkshire Grey.” (To watch Palm’s track record, click here.)

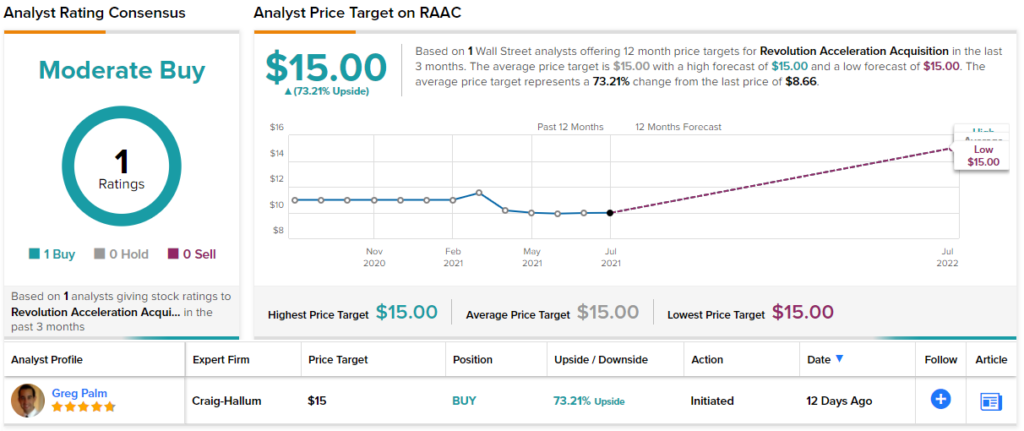

In line with these comments, Palm rates RAAC shares as a Buy, and sets a $15 price target suggesting post-merger growth of 73%. Palm’s is the only review on record for RAAC, which is currently priced at $8.66. (See RAAC’s stock analysis at TipRanks.)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.