Technology sector can be the most dynamic of all the stock categories on Wall Street because innovation drives performance more than changing market tastes or even large-scale investing. The right idea at the right time can turn an invention into a household name and investors into happy beneficiaries of profit.

The flip side is also accurate, though. When great ideas are executed poorly, technicians move forward without the help of business and logistics experts, or a good concept is eclipsed by a better one, the once-promising stock becomes next to worthless. Picking the winners from the also-rans can be tricky business.

When great ideas are executed poorly, technicians move forward without the help of business and logistics experts, or a good concept is eclipsed by a better one, the once-promising stock becomes next to worthless.

Submitted for your consideration are the dozen technology stocks most analysts predict will do well as we exit the COVID-19 pandemic.

Top 12 Technology Stocks to Consider for Your Q2 Portfolio in 2021

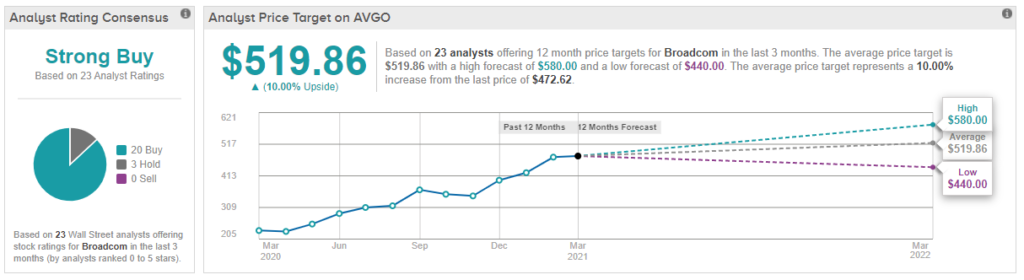

1. Broadcom Inc.

Broadcom has been a steady and reliable player in the field, delivering necessary components to electronics manufacturers that connect to other devices using Bluetooth, Wi-Fi, and 5G. Since demand for all of those things has steadily increased in recent years, so too has Broadcom’s stock price and prospects.

The big news for Broadcom recently is a 2020 announcement that Intel may begin outsourcing some of their manufacturing to Broadcom. The report resulted in a 35% increase in the stock and investor excitement.

By the Numbers

- NYSE: AVGO

- Main Revenue Streams: Semiconductor manufacturing

- Main Industries: Technology components

- Market Value: $175.5 billion

- Value as of End-March 2021:$472.62

- Average Price Target: $519.86 (10% Upside)

- Analyst Consensus: Strong Buy

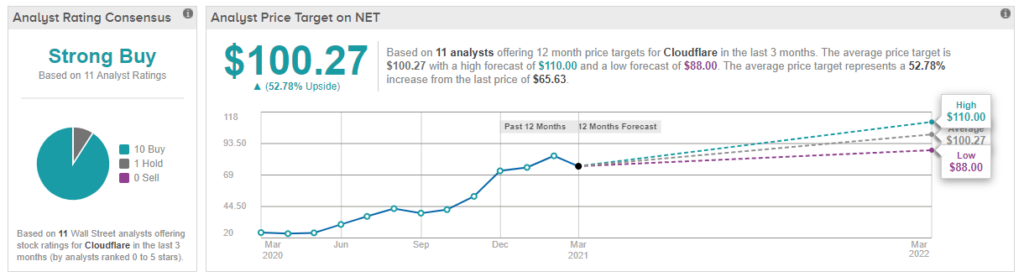

2. Cloudflare Inc.

Cloudflare’s security and web performance services are aimed at high-rolling corporations and nonprofits that need reliable, secure internet and intranet to make their operations work. They deliver with a combination of heavy technology investment, proprietary methods, and strong market positioning.

Cloudflare experienced a 50% revenue expansion in 2020 and anticipates at least 30% moving forward in 2021. Like many other stocks on this list, they saw a massive increase in demand as the world moved to remote work and will continue to benefit from the trend for several quarters to come.

By the Numbers

- NYSE: NET

- Main Revenue Streams: Cybersecurity, IT

- Main Industries: Business services

- Market Value: $26.1 billion

- Value as of End-March 2021:$65.63

- Average Price Target: $100.27 (52.78% Upside)

- Analyst Consensus: Strong Buy

3. GoDaddy Inc

It’s been the better part of a decade since GoDaddy’s infamous partnership with Hulk Hogan made waves across the internet, but this niche brand continues to grow. They added a million net new customers in 2020, with a 20% stock surge in August 2020.

Although some analysts suggested this tech company was piggybacking on unemployed people starting small projects while locked down, GoDaddy’s wide range of recurring services has them set for solid earnings in the coming year as well.

By the Numbers

- NYSE: GDDY

- Main Revenue Streams: Domain registration, web hosting, web design

- Main Industries: Small-business services, consumer internet

- Market Value: $14.3 billion

- Value as of End-March 2021:$77.10

- Average Price Target: $108.71 (41.00% Upside)

- Analyst Consensus: Strong Buy

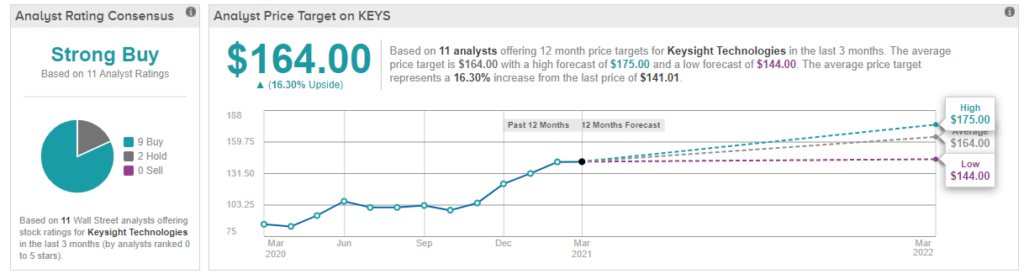

4. Keysight Technologies Inc

Testing and measurement at the level needed for engine parts or semiconductor chips are expensive, requiring equipment and expertise most manufacturers can’t afford to keep in house. So they hire a tech company like Keysight to test and report as part of R&D and production quality control.

Keysight has been a solidly performing dark horse stock, experiencing a 15% jump in 2020 after their June acquisition of Eggplant. They’re poised to leverage that new position in the coming months.

By the Numbers

- NYSE: KEYS

- Main Revenue Streams: Electronic design, electronic testing and measurement

- Main Industries: Aerospace, automotive, energy, technology

- Market Value: $24.4 billion

- Value as of Mid-March 2021:$140.93

- Average Price Target: $164.00 (16.37% Upside)

- Analyst Consensus: Strong Buy

5. Lattice Semiconductor Corp

Most chipmakers suffered flat growth or declines in 2020 as supply chain issues from COVID-19 lockdowns and border security upgrades made both production and delivery problematic. Lattice Semiconductor bucked the trend, posting modest but consistent gains as each quarter ticked past.

Their smaller size coupled with steady niche growth makes them ripe for acquisition, with many analysts predicting a swift, profitable takeover soon.

By the Numbers

- NYSE: LSCC

- Main Revenue Streams: Electronic design, electronic testing and measurement

- Main Industries: Aerospace, automotive, energy, technology

- Market Value: $6 billion

- Value as of End-March 2021:$42.64

- Average Price Target: $53.86 (26.31% Upside)

- Analyst Consensus: Strong Buy

6. Leidos Holdings Inc

Leidos serves as a technology partner to government agencies, NGOs, and other enterprise-tier businesses. More than half of their income comes from contracts with the U.S. Department of Defense, a stable moneymaker that shows no signs of stopping despite the new presidential administration.

The infrastructure and public investment strategies promised under the Biden administration make it likely Leidos and others of its ilk will see more and larger government contracts in the coming years.

By the Numbers

- NYSE: LDOS

- Main Revenue Streams: Cybersecurity, data analytics, logistics

- Main Industries: Civil services, defense, public health

- Market Value: $14.8 billion

- Value as of End-March 2021:$95.63

- Average Price Target: $114.88 (20.00% Upside)

- Analyst Consensus: Strong Buy

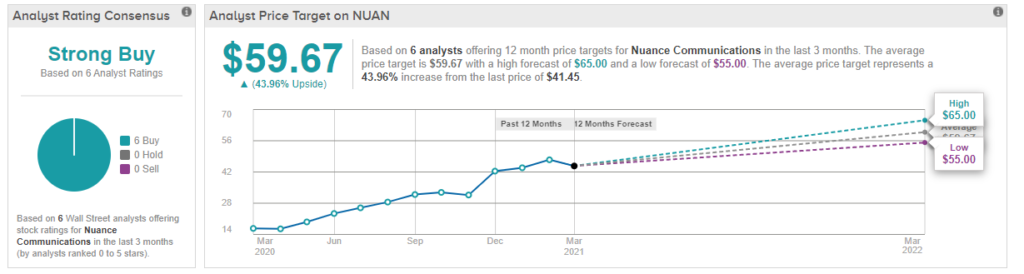

7. Nuance Communications Inc

At this time last year, Nuance was just another runner in the race for artificial intelligence solutions behind voice recognition, biometric authentication, medical transcription, and similar technologies.

Last November, however, their record-breaking performance exceeded predictions so much they saw a 15% increase in their value in a single session, with a total gain of 150% in 2020 despite the year’s economic upheavals.

By the Numbers

- NYSE: NUAN

- Main Revenue Streams: Artificial intelligence, imaging, voice recognition

- Main Industries: Communications, government, health care, security

- Market Value: $12.5 billion

- Value as of End-March 2021: $41.67

- Average Price Target: $59.67 (43.20% Upside)

- Analyst Consensus: Strong Buy

8. Palo Alto Networks Inc

Palo Alto showed remarkable growth in 2020, more than tripling the S&P 500’s performance over that year. They expect similar gains in the coming years owing to two complementary advantages. The rise in remote computing, along with the highly publicized cyberattacks by Russia and China around the election, have escalated interest and investment in the cybersecurity sector.

This trend helps both Palo Alto and its competitors. Their next-generation security and firewall products are still on the bleeding edge of this hotly contested field, positioning them for success in 2021.

By the Numbers

- NYSE: PANW

- Main Revenue Streams: Cybersecurity

- Main Industries: Business services, government

- Market Value: $35.5 billion

- Value as of End-March 2021:$314.80

- Average Price Target: $446.21 (41.74% Upside)

- Analyst Consensus: Strong Buy

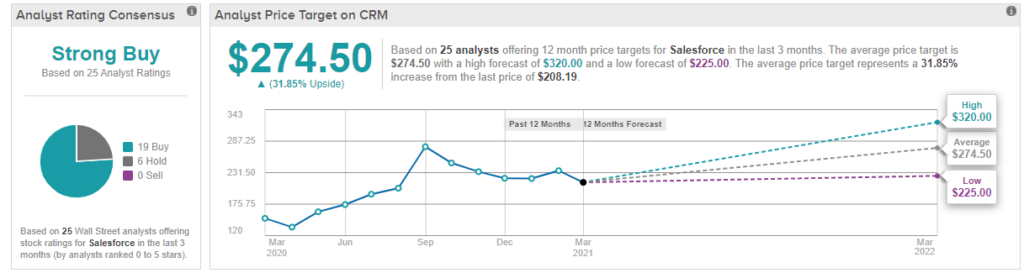

9. Salesforce.com Inc

One of the most recognizable brands on this list, Salesforce stands to gain from its strong public relations and publicity investments of the past few years. They took a hit in Q4 2020 when they announced their buyout of business communications staple Slack Technologies. However, even with that downturn, they posted nearly 40% gains for 2020 and have grown almost 200% since 2015.

As we enter the post-pandemic world, a greater reliance on remote computing and remote work suggests this newly forged partnership is poised for aggressive growth.

By the Numbers

- NYSE: CRM

- Main Revenue Streams: Cloud computing

- Main Industries: Business services, marketing

- Market Value: $206.6 billion

- Value as of Mid-March 2021:$208.26

- Average Price Target: $274.50 (31.83% Upside)

- Analyst Consensus: Strong Buy

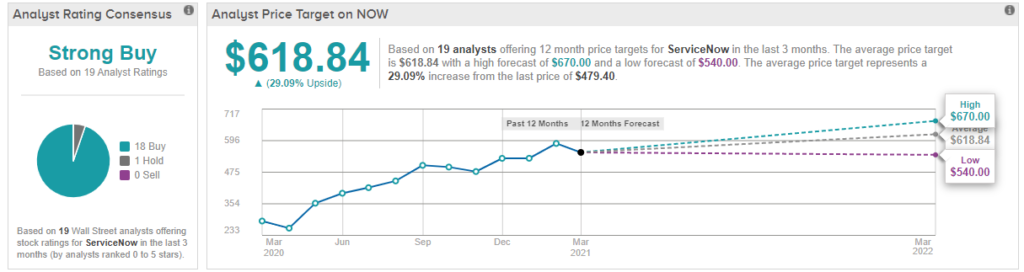

10. ServiceNow Inc

ServiceNow is among the leading brands of enterprise-tier IT. Though many companies of this size and tenure begin posting slower — if more reliable — gains, ServiceNow had 20% growth in 2020 and is expected to do the same this year.

As more and more businesses continue to invest more deeply in streamline operations, you can expect more and more of them to seek this top name’s guidance and services in this highly specialized field…

By the Numbers

- NYSE: NOW

- Main Revenue Streams: Business automation, workflow integration

- Main Industries: Business services, government

- Market Value: $108.1 billion

- Value as of End-March 2021:$479.40

- Average Price Target: $618.84 (29.09% Upside)

- Analyst Consensus: Strong Buy

11. Twilio Inc

It’s almost as if Twilio had a crystal ball pointed at 2020 when they designed their services. Their technology processes mobile-friendly content like text messages and videos, two technologies we relied on extensively during lockdowns.

The company’s stock shot up 270% that year alone and plotted 30% gains in 2021 as the remote work trends continue.

By the Numbers

- NYSE: TWLO

- Main Revenue Streams: Cloud computing, communications apps

- Main Industries:Third-party business services

- Market Value: $58.2 billion

- Value as of Mid-March 2021: $311.71

- Average Price Target: $508.38 (63.09% Upside)

- Analyst Consensus: Strong Buy

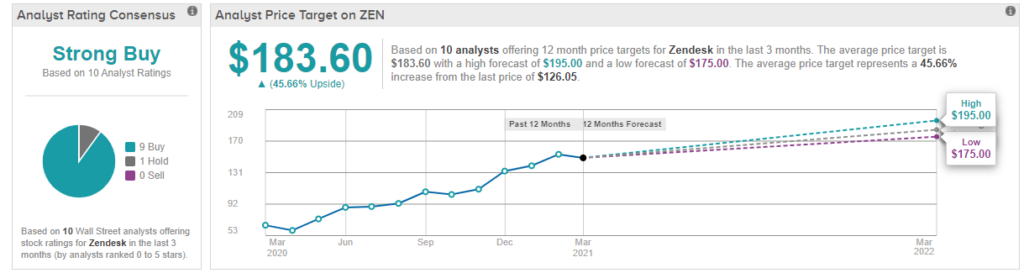

12. Zendesk Inc

COVID-19 turned Zendesk into a significant player. Their primary focus is software to automate and analyze remote customer performance, content funnels, and similar sales channels. When in-person sales took a nosedive, many of their customers doubled down on their buy-in, and many potential clients sealed the deal.

Zendesk saw a 25% increase in sales and an 85% jump in their share value during 2020. They anticipate another 25% revenue growth in the coming year.

By the Numbers

- NYSE: ZEN

- Main Revenue Streams: Analytics, relationship management software

- Main Industries:Business services

- Market Value: $16.7 billion

- Value as of End-March 2021:$126.05

- Average Price Target: $183.60 (45.66% Upside)

- Analyst Consensus: Strong Buy

Final Thought: Some Boats You Haven’t Missed

The rapidly changing face of technology means there’s no such thing as a “sure thing” stock, but a few reliable performers remain solid investments. For example, Apple (NYSE: AAPL), Amazon (NYSE:AMZN), Microsoft (NYSE:MSFT), Paypal (NYSE:PYPL), and Google (NYSE:GOOGL) are predicted to continue to gain value throughout 2021.

You won’t see the massive profits you made for these companies during their initial rise to prominence, but you’re unlikely to lose money in the next few years. You haven’t missed the boat for profiting from an investment in these reliable technology giants.

Roger Toney is a personal day trader and follows the market closely.