Most people don’t think too much about asthma treatments. But for biotech stock Arrowhead Pharmaceuticals (NASDAQ:ARWR), asthma isn’t only a big part of its operation but also a big part of why its share prices shot up over 14% at the time of writing.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Arrowhead brought out new results from a Phase 1 / 2 trial for a treatment known as ARO-RAGE. ARO-RAGE is an RNA interference therapeutic measure that’s meant to help with asthma. The first part of the trial delivered some impressive results, including a 90% decline in the substance that’s said to involve the inflammation connected to asthma after just two doses. It didn’t stop there, though; there was also an 80% drop in the mean maximum quantities of the substance in question. A placebo, meanwhile, could only generate a 1% drop.

Further, the drug seemed safe, with no “serious or severe” adverse conditions reported. All great news, but it gets even better. It’s already received a couple of significant milestone payments from other drugs in testing like one to treat those with non-alcoholic steatohepatitis and one for liver disease connected to an alpha-1 antitrypsin deficiency. Christopher Anzalone, Arrowhead’s president and CEO, noted that the interim data reports “…represent clinical valuation of Arrowhead’s inhaled pulmonary TRiM platform…”

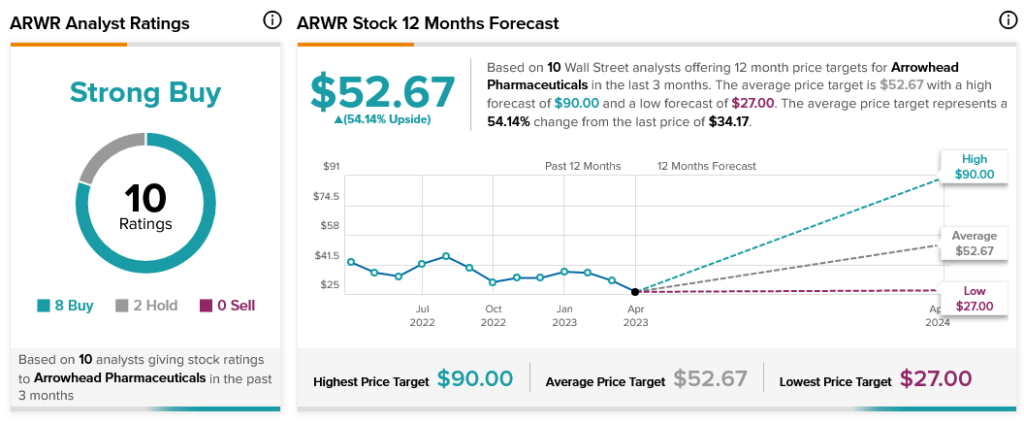

Overall, Arrowhead Pharmaceuticals stock is considered a Strong Buy by analyst consensus, with Buy ratings outweighing Holds by four to one. Further, with an average price target of $52.67, ARWR stock offers an exciting 54.14% upside potential.