For solar stock Array Technologies (NASDAQ:ARRY), the hits just kept on coming as it picked up some fresh accolades from Bank of America. The kind word gained therein was enough juice to add over 4% to Array’s market cap in the closing minutes of Tuesday’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Bank of America, via analyst Julien Dumoulin-Smith, had a lot of good to say about Array Technologies. One of the first—and biggest—points on the list was to call it a stock that featured “…best-in-class margin potential with a growth option still.” Throw in the fact that it was “…one of the most differentiated stories,” and Array Technologies becomes a winner worthy of Bank of America’s U.S. 1 List.

That’s a big enough step by itself, but there’s also plenty more that’s happened recently. We’ve already seen how Array built up a new deal with Steel Dynamics (NASDAQ:STLD), and in the process, gave itself access to a new array of coil steel for its single-axis solar trackers systems. Perhaps less known, however, is the deal Array made with the Extruded Aluminum Corporation (EAC) that would give it access to aluminum and also help EAC land one of the biggest aluminum presses that Michigan has ever seen. These points together demonstrate Array’s commitment to keeping its supply lines up and running. Given the troubles businesses have had with supply chains as of late, Array’s move should elevate its standing accordingly.

What is the Price Target for ARRY Stock?

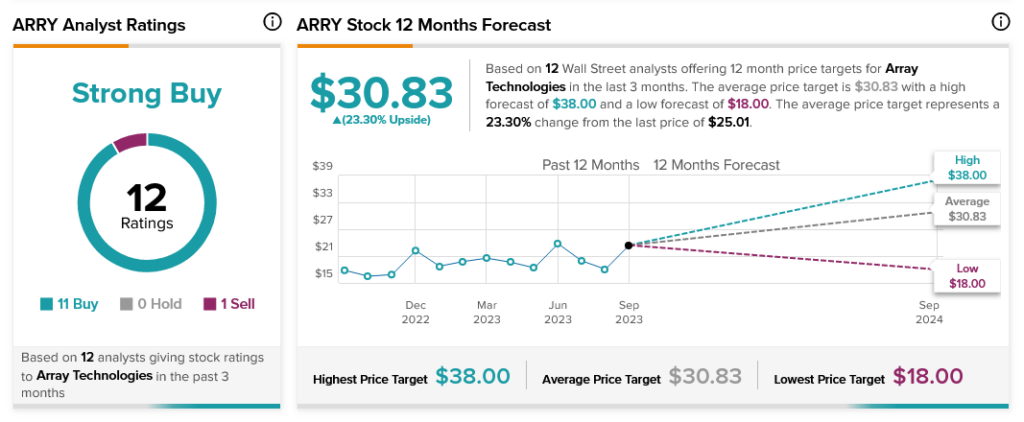

Analysts, meanwhile, are in utter agreement, as consensus calls Array Technologies stock a Strong Buy supported by 11 Buy ratings and one Sell. Meanwhile, Array Technologies stock also offers 23.3% upside potential, thanks to its average price target of $30.83.