Array Technologies (NASDAQ:ARRY), a manufacturer of ground-mounting systems for solar energy projects, is set to release its Q4 FY2023 results on Tuesday, February 27. This could present an inflection point for investors hoping to bounce back from the recent stock decline. While Wall Street analysts are split on the stock, their consensus price target suggests a healthy upside potential given the current valuation.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Renewable Energy Focus

Based in Albuquerque, New Mexico, Array Technologies manufactures ground-mounting systems used in solar energy projects.

The company’s product is an integrated system of steel supports, electric motors, gearboxes, and electronic controllers, referred to as a single-axis tracker, which moves solar panels throughout the day to maintain an optimal orientation to the sun, increasing their energy production.

Most of Array Technologies’ revenue comes from operations in the United States. However, the company recently announced a new strategic partnership with Alupco, a leading aluminum products company in the Middle East and North Africa, to support the growing market for renewable energy projects in the region.

Valuation Ahead of Upcoming Earnings

With the stock down 41% over the past six months, investors will look for signs of a turnaround when the company releases its Q4 FY2023 next week. Analysts expect the company to report earnings per share of $0.11, reflecting a 10% year-over-year increase. They project revenue to decline by 21.6% to $315.25 million.

Any positive earnings surprise might give investors the catalyst they are looking for to provide the stock with some sustained positive momentum to higher levels.

However, ARRY stock’s current valuation metrics present a mixed view. The PE Ratio (price-to-earnings) of 34.5 seems rather rich relative to the sector average of 24.1. However, ARRY stock’s current price is undervalued based on the EV to EBITDA ratio (trailing 12 months) of 10.53, given the stock’s historical valuation and when compared to the sector average of 13.17. The EV/EBITDA ratio is used to look at a company’s true (or enterprise) value based on how much money it is earning before interest, taxes, depreciation, and amortization.

Analyst Coverage

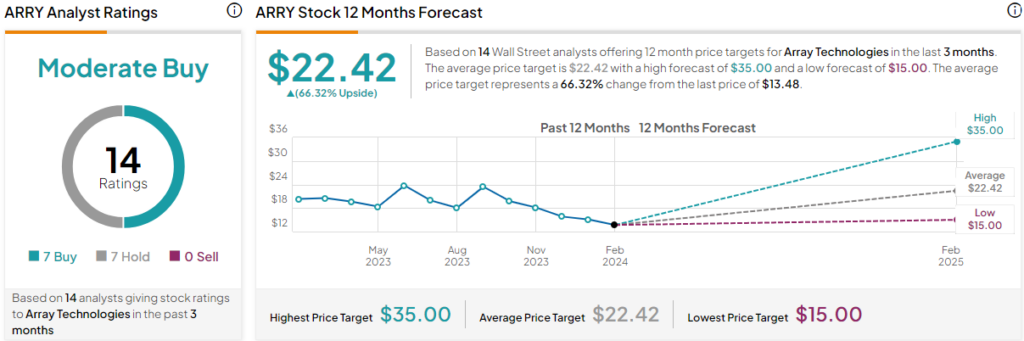

Analyst enthusiasm for the stock has been relatively neutral recently.

Last month, Jefferies analyst Dushyant Ailani reaffirmed a Hold rating on Array Technologies, lowering the price target to $15 from $18, citing expectations that the firm will “muddle through in ’24.”

Likewise, Citi’s Vikram Bagri lowered the firm’s price target to $16.50 from $22, reiterating a Hold rating on the shares. In a research note to investors, Bagri shared that he expects the company’s Q4 report to be broadly in line with the consensus but could warn on 2024 revenue.

Jordan Levy at Truist was a little more bullish, however. While the analyst lowered the firm’s price target to $25 from $30, he kept a Buy rating on ARRY stock partly based on the meaningful upside opportunity the residential solar group created with the Fed moving into a potential rate cut cycle.

What is the Forecast for ARRY in 2024?

ARRY is currently rated a Moderate Buy based on the ratings from the 14 Wall Street analysts who have reviewed the stock in the last three months. The average price target is $22.42, with a high forecast of $35 and a low forecast of $15. The average price target represents a 66% upside from the current levels.

Final Thoughts

While the substantial decline in ARRY stock price may raise eyebrows, the company’s forthcoming Q4 FY2023 results may provide key indicators towards the future trajectory, and any positive earnings surprise could spark a turnaround.

Aside from any short-term movement that Array Technologies stock may get from reactions to earnings, investors should keep in mind the bigger picture – the long-term profitability and growth potential created by the new strategic partnership in the Middle East and the potential springboard provided by potential interest rate cuts.