Aritzia (TSE: ATZ) reported a strong rise in revenue and profit in Q3 2022, supported by a surge in its e-commerce business.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Revenue & Earnings

Net revenue for Q3 2022 came in at C$453.3 million, an increase of 62.9% from Q3 2021 and 69.6% from Q3 2020. Aritzia continues to experience unprecedented sales acceleration in the United States, where net revenues increased 115.1% to C$198.7 million, compared to C$92.4 million in the third quarter of 2021.

Comparable sales grew 58% year-over-year and 26% from pre-pandemic levels in Q3 2020. Retail revenue came in at C$305.3 million, 72% higher than a year ago and 44.8% from two years earlier. E-commerce revenue grew 46.9% in the quarter ended August 29 to C$148 million, representing 32.6% of net revenues in Q3 2022. This is up 162.2% from Q3 2020.

Adjusted net income amounted to C$0.61 per diluted share, compared to C$0.29 per diluted share in Q3 2021 and C$0.32 per diluted share in Q3 2020.

Cash and cash equivalents at the end of the third quarter were C$305.9 million, compared to C$174 million at the end of the third quarter of 2021.

Inventories at the end of the third quarter were C$176.9 million, compared to C$138.1 million at the end of the third quarter of 2021. The company said it continues to maintain a healthy inventory position despite the disruption in the chain global supply.

CEO Commentary

Aritzia founder, chairman and CEO Brian Hill said, “Our strong performance has continued in the fourth quarter to date, despite the recent resurgence of COVID-19, associated supply chain and labour headwinds. As I reflect on our brand acceleration, new client acquisition and the performance of our business in the United States, I see extraordinary opportunities for Aritzia. Our business has never been stronger or better positioned for growth, as we continue to drive digital innovation of our eCommerce channel and Omni capabilities, accelerate boutique growth, expand our product assortment, and acquire new clients, all while continuing to strategically invest in our infrastructure and growing our team of world-class talent.”

Outlook

Aritzia has raised its outlook for fiscal 2022. It is now expecting net revenue in the range of C$1.425 billion to C$1.45 billion, compared to a previous outlook of C$1.25 billion to C$1.3 billion.

Wall Street’s Take

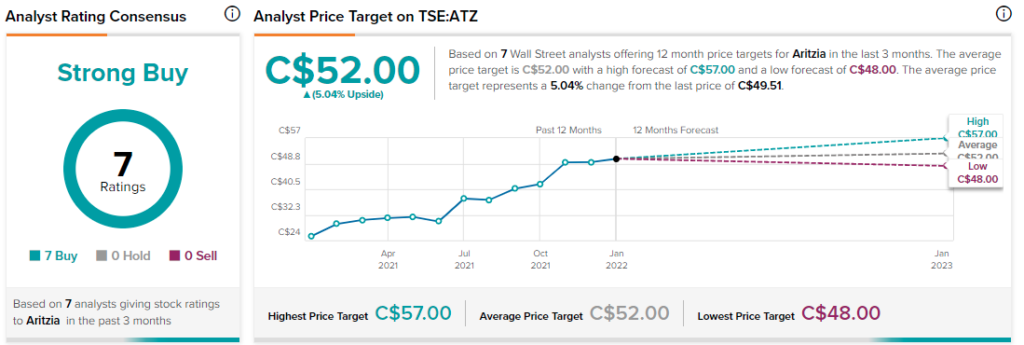

On January 6, Canaccord Genuity analyst Derek Dley kept a Buy rating on ATZ and set a price target of C$57. This implies 15.1% upside potential.

The rest of the Street is bullish on ATZ with a Strong Buy consensus rating, based on seven Buys. The average Aritzia price target of C$52 implies upside potential of 5% to current levels.

Download the TipRanks mobile app now

Related News:

B&M European Value Retail Reports Q3 Results

Supermarket Income REIT Buys 2 U.K. Supermarkets