The stock of Arista Networks (ANET) is down 6% on Nov. 5 even though the company reported financial results that beat Wall Street forecasts on the top and bottom lines.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company, which makes hardware for data centers, announced third-quarter earnings per share (EPS) of $0.75, which topped the consensus expectation of $0.72. Revenue of $2.31 billion surpassed the $2.26 billion that was anticipated on Wall Street. Sales were up 27% from a year earlier.

Despite the strong print, ANET stock is down on the day amid a broader pullback in stocks associated with the AI trade. In a note to clients, Raymond James (RJF) wrote that the decline might be due to “elevated expectations and no real fundamental shift” at the company.

Growing Concerns

Heading into the third-quarter results, ANET stock had gained more than 30% this year. The company specializes in network switches that facilitate the transfer of information within data centers. Based in Silicon Valley, Arista Networks is viewed as a beneficiary of the AI trade.

The company counts Microsoft (MSFT) and Meta Platforms (META) among its largest customers. However, ANET stock might be taking a hit as investors grow increasingly worried about a potential AI bubble forming in the stock market. Advanced Micro Devices (AMD) also just reported Q3 results that surpassed Wall Street forecasts and its share price initially fell 5%.

Is ANET Stock a Buy?

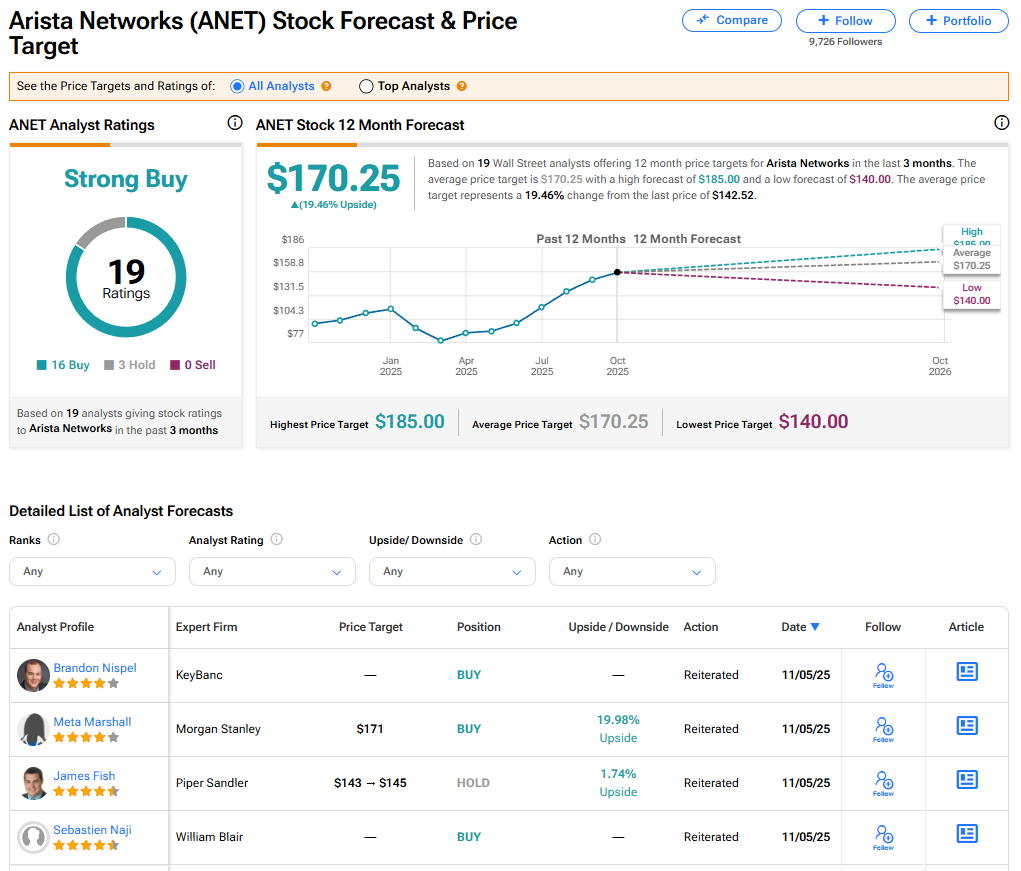

The stock of Arista Networks has a consensus Strong Buy rating among 19 Wall Street analysts. That rating is based on 16 Buy and three Hold recommendations issued in the last three months. The average ANET price target of $170.25 implies 19.46% upside from current levels.