Ardelyx, Inc. (ARDX) has revealed plans to launch IBSRELA, the company’s approved treatment for irritable bowel syndrome with constipation (IBS-C) in adults, in the second quarter of 2022. Following the news, shares of the specialty biopharmaceutical company rose 7% in the extended trading session on Tuesday after closing 32.2% higher on the day.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

IBSRELA (tenapanor) is the first-of-its-kind NHE3 inhibitor, which was approved based on two successful Phase 3 trials. Both trials met their primary and most secondary endpoints.

According to the company, over the last five years, the IBS-C market has grown substantially and is in need of new therapeutic options to meet the medical needs of patients currently treated for IBS-C. Therefore, Ardelyx expects IBSRELA to generate at least $500 million in annual net revenue.

See Top Smart Score Stocks on TipRanks >>

CEO Comments

The CEO of Ardelyx, Mike Raab, said, “As we work to bring IBSRELA to patients, we remain intent on pursuing approval of tenapanor for hyperphosphatemia through the formal dispute resolution process with the FDA, and as a commercial facing organization, if approved, we will be well-positioned to bring this novel therapy to patients.” (See Ardelyx stock charts on TipRanks)

Wall Street’s Take

Following the recent update, Wedbush analyst Laura Chico reiterated a Hold rating on the stock but lifted the price target to $2 from $1.

Chico said, “Management anticipates commercial supply will be available by 2Q22 and will deploy a field force to launch the drug. The move appears to be a stark change in messaging and strategy since Ibsrela was first approved in 2019…With ARDX working through the Formal Dispute Resolution process with FDA for tenapanor, advancing Ibsrela has become the more near-term opportunity.”

Consensus among analysts is a Hold based on 3 unanimous Holds. The average Ardelyx price target of $2 implies 75.44% upside potential from current levels. Shares have lost 81.4% over the past year.

Risk Analysis

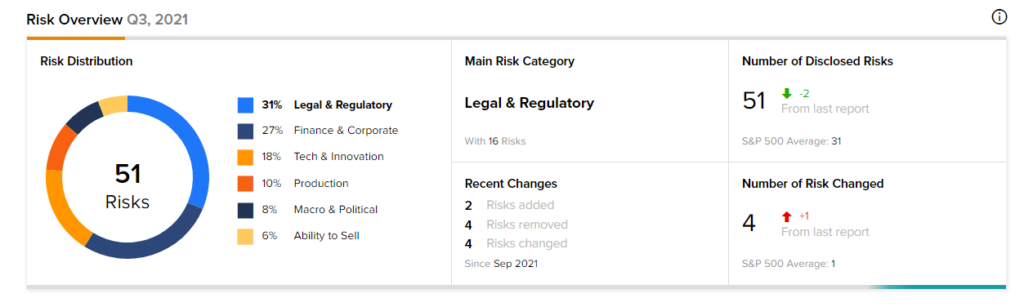

According to the new TipRanks’ Risk Factors tool, the Ardelyx stock is at risk mainly from three factors: Legal and Regulatory, Finance and Corporate, and Tech and Innovation, which contribute 31%, 27%, and 18%, respectively, to the total 51 risks identified for the stock.

Related News:

Accenture Renews Joint Investments with AWS

MicroStrategy Buys Additional Bitcoins; Shares Jump 4.9%

UnitedHealth Provides Outlook for 2021 & 2022; Street Says Buy