Shares of Archer Aviation (ACHR) were down 11% in Friday’s pre-market trading after the electric vertical takeoff and landing (eVTOL) aircraft developer reported its third-quarter results and announced that it has signed a series of agreements to acquire Hawthorne Airport in Los Angeles (LA) for $126 million. Archer intends to use Hawthorne Airport as an operational hub for its planned LA air taxi network and as a testing ground for its aviation tech. Despite a narrower-than-anticipated loss per share, ACHR stock fell as the announcement of $650 million in new equity capital seemed to have raised concerns about shareholder dilution.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The company stated that the additional funding brings its total liquidity to over $2 billion.

More on Archer Aviation’s Q3 Performance

Archer Aviation reported a narrower loss per share of $0.20 for Q3 2025 compared to $0.29 in the prior-year quarter and better than the Street’s consensus of a loss per share of $0.30.

However, adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization) loss widened to $116.1 million in Q3 2025 from $93.5 million in the prior-year quarter, as non-GAAP operating expenses increased $24.4 million due to investments in “people-related” costs to support the company’s commercialization plans. Meanwhile, Archer Aviation ended the third quarter with cash, cash equivalents, and short-term investments of $1.64 billion.

ACHR is a pre-revenue company. CEO Adam Goldstein expects the company to start recognizing revenue in the first quarter of 2026, as it moves toward commercialization. As of Thursday’s closing, ACHR stock was down 9% year-to-date but has rallied 177% over the past year.

Looking ahead, Archer expects an adjusted EBITDA loss in the range of $110 million to $140 million for the fourth quarter of 2025.

Is ACHR a Good Stock to Buy?

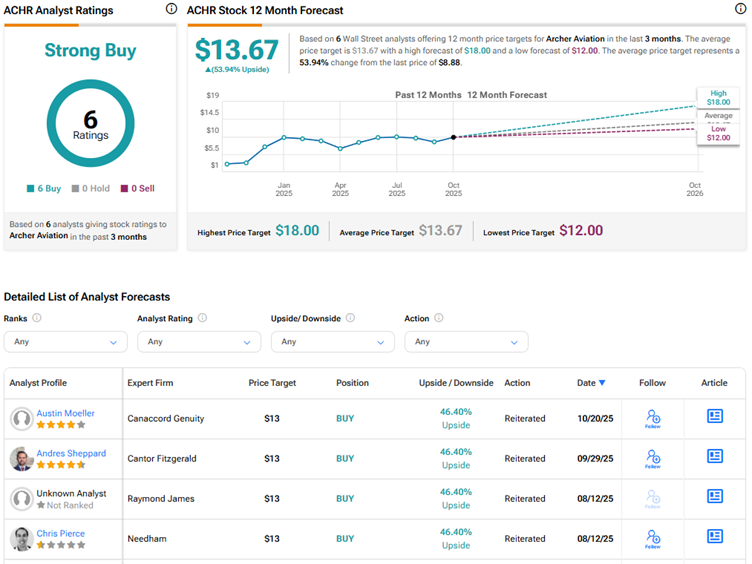

Currently, Wall Street has a Strong Buy consensus rating on Archer Aviation stock based on six unanimous Buys. This optimism is based on several partnerships and growing interest in the eVTOL space. The average ACHR stock price target of $13.67 indicates 54% upside potential.

Note that these ratings/price targets are expected to be revised as analysts react to the Q3 results and other updates.