Archer Aviation (ACHR) is adding to its technology base. The electric aircraft maker announced it won a bid to buy around 300 patents from Lilium (LILMF) GmbH for about €18 million, or close to $19 million. The deal adds to Archer’s growing list of over 1,000 patent assets worldwide.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The patents include work on ducted fans, propeller systems, electric engines, flight controls, battery management, and high-voltage systems. Lilium spent more than $1.5 billion developing these technologies since its founding in 2015. Archer’s management said the purchase adds key tools to improve its aircraft design and future models.

Meanwhile, ACHR shares closed at $13.02 yesterday, on October 14, up nearly 2%. The stock rose another 2.9% to $13.34 in pre-market trading. So far this year, shares have risen about 34%.

Industry Shift and Market View

By acquiring Lilium’s patents, Archer is securing assets that can support both its current aircraft and new designs targeting regional travel and light-sport markets. The move also follows new U.S. aviation rules announced in July under the MOSAIC program. These rules aim to modernize airworthiness standards for small aircraft and may help Archer expand its reach.

The company said the deal strengthens its position as a U.S. leader in electric flight and reflects its long-term plan to bring certified aircraft to market.

Is Archer Aviation Stock a Good Buy?

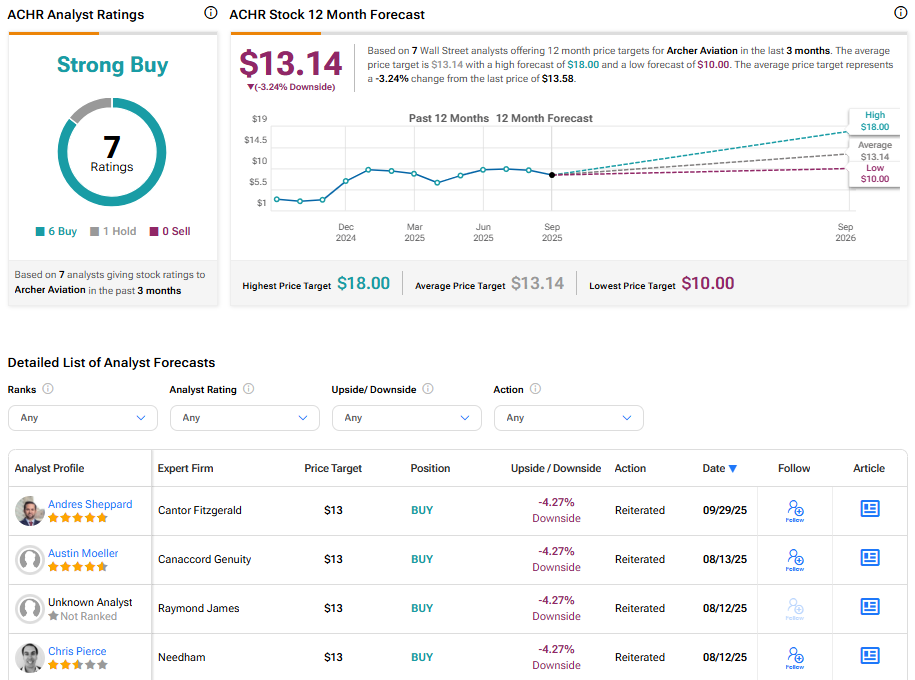

On Wall Street, analysts remain optimistic about the company’s prospects. Based on seven recent ratings, Archer Aviation boasts a “Strong Buy” consensus with an average 12-month price target of $13.14. This implies a 3.24% downside from the current price.