Archer Aviation (ACHR), one of the major players in the eVTOL industry, has filed a new prospectus detailing plans to issue up to $5 million in warrants tied to its Class A common stock. The company will not receive cash for these warrants. Instead, they will be granted to a service provider as payment for work performed. Each warrant gives the holder the right to buy Archer shares for $0.01, which is almost free compared to the current market price.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In the meantime, ACHR shares climbed 3.48% on Friday, closing at $11.29.

Issued Over Time Based on Results

The warrants will not be issued all at once. Instead, they will be granted in phases as the service provider meets specific performance goals. Each time a milestone is reached, Archer will calculate the number of shares to issue based on the average trading price of its stock over the 10 days preceding that date. This means that if Archer’s share price rises, the provider will get fewer shares, and if it falls, it will receive more shares.

Archer’s filing sets the total value at $5 million, so the number of shares issued will depend on the company’s stock price at each milestone. The company’s stock is currently trading at $11.29, while its public warrants traded at $3.54.

Limited Cash Outflow but Some Dilution

The key takeaway is that this type of deal lets Archer conserve cash while compensating a partner or contractor. The structure links payment to results and aligns both sides with the company’s progress. However, when the warrants are exercised, Archer’s total share count will increase. That could lead to mild dilution for existing shareholders, since the shares will be issued at a near-zero price.

Overall, the warrant plan shows Archer’s effort to manage its spending as it moves toward its next phase of operations, while still rewarding partners who help it reach key business goals.

Is Archer Aviation Stock a Good Buy?

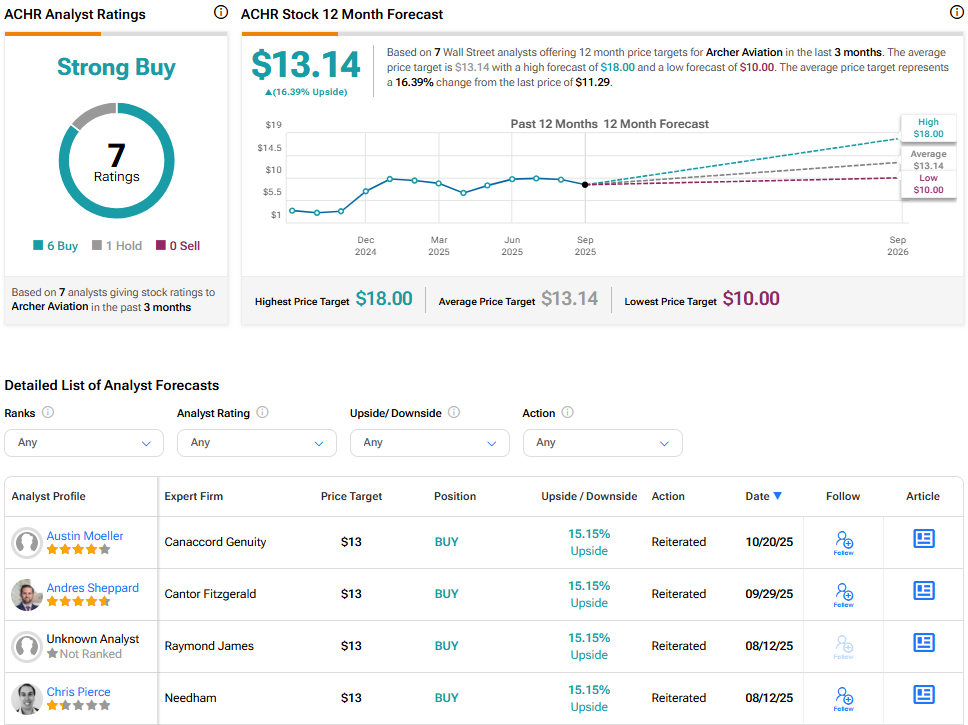

On Wall Street, analysts remain optimistic about the company’s prospects. Based on seven recent ratings, Archer Aviation boasts a “Strong Buy” consensus with an average 12-month price target of $13.14. This implies a 16.39% upside from the current price.