Applied Digital (APLD) stock gained on Thursday after the digital infrastructure and blockchain technology company received updated analyst coverage. Compass Point analyst Michael Donovan reiterated a Buy rating for APLD stock with a $30 price target, suggesting a possible 8.7% upside for the company’s shares.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The Compass Point analyst provided a bull argument for why investors should be interested in Applied Digital stock. He highlighted the company’s lease of its Forge 1 facility to CoreWeave (CRWV), which has secured the company a long-term source of revenue. He noted that this is an example of the increased demand for high-density rack loads and is evidence of Applied Digital’s execution capabilities.

The analyst also noted that there’s a high possibility that Applied Digital secures a similar deal with a hyperscaler for its Forge 2 facility, which is an optimistic view on future revenue streams for the company. However, this won’t happen until the Forge 2 facility is ready, as it’s currently under construction. He pointed out that the decision to build Forge 2 so quickly will allow the company to capitalize on immediate market opportunities.

Applied Digital Stock Movement Today

Applied Digital stock was up 8.6% on Thursday, extending a massive 255.37% year-to-date rally. The shares have also climbed 210.95% over the past 12 months. APLD is among the many digital infrastructure companies that have benefited from the AI boom in 2025.

Is Applied Digital Stock a Buy, Sell, or Hold?

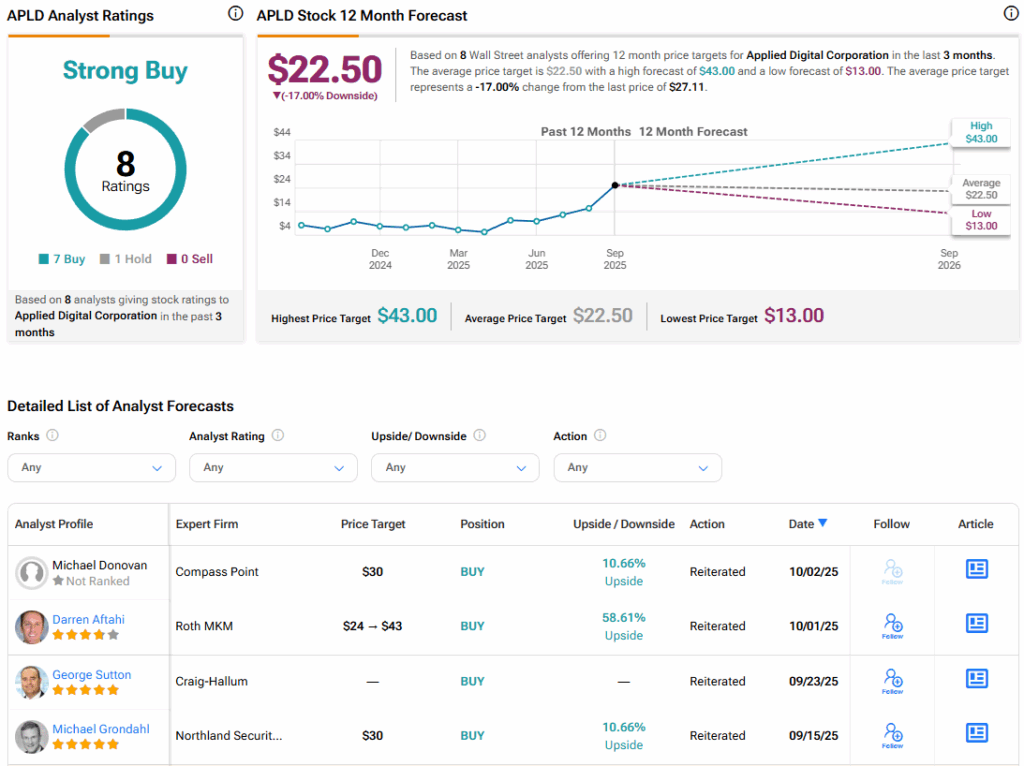

Turning to Wall Street, the analysts’ consensus rating for Applied Digital is Strong Buy, based on seven Buy ratings and a single Sell rating over the past three months. With that comes an average APLD stock price target of $22.50, representing a potential 17% downside for the company’s shares.