Apple’s (NASDAQ:AAPL) shipments of personal computers (PCs) jumped 20.8% year-over-year in the second quarter, according to IDC research. This was followed by an increase of 13.7% year-over-year in PC shipments for the Acer Group.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Details of Apple’s PC Shipments Data

According to preliminary data from IDC, global shipments of personal computers rose by 3% year-over-year to 64.9 million units in the second quarter, driven by demand for AI-capable devices, with Apple experiencing the largest growth among PC makers. This marks the second consecutive quarter of growth after two years of decline in PC shipments.

Ryan Reith, IDC’s group vice president, stated that the PC market is expected to rebound from a post-pandemic lull, with growth fueled by AI hype and a commercial refresh cycle.

Regarding the Chinese market, PC shipments remained weak, but excluding China, global shipments grew by more than 5% year-over-year. Overall, Lenovo held the largest market share of the global PC market at 22.7%, followed by HP (NYSE:HPE) at 21.1%. Dell (NYSE:DELL), while holding a market share of 15.5%, saw its PC shipments fall by 2.4%.

AAPL’s PC Business

Apple’s PC (Mac) business contributes a relatively smaller share of its revenues compared to the iPhone. In the fiscal second quarter, Apple’s PCs generated $7.5 billion in revenue, marking a 4% year-over-year increase and accounting for over 7.5% of its total revenue of $90.8 billion.

Is Apple a Buy, Sell, or Hold Stock?

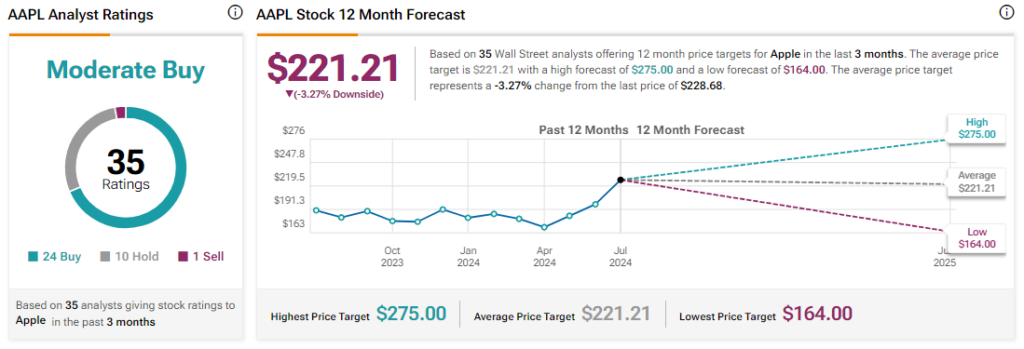

Analysts remain cautiously optimistic about AAPL stock, with a Moderate Buy consensus rating based on 24 Buys, 10 Holds, and one Sell. Over the past year, AAPL has increased by more than 20%, and the average AAPL price target of $221.21 implies a downside potential of 3.3% from current levels.