Apple (NASDAQ:AAPL), the tech giant, seems to be quickly moving its supply chain away from China. The Wall Street Journal reported that Apple is aiming to make 25% of its iPhones in India. The company and its suppliers are looking at manufacturing more than 50 million iPhones annually in India over the next two to three years. However, China will remain the biggest iPhone producer for AAPL.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Its main supplier, Foxconn’s plant in the Southern state of Karnataka, is expected to be operational from April. This plant will manufacture 20 million iPhones annually over the next two to three years. Another Foxconn plant in India is in the early stages of planning.

Apple also intends to manufacture lower-end iPhones in India by 2025, a shift from China. Foxconn has already signaled an investment of $1.5 billion in India.

Meanwhile, in another strategic move, the firm is shifting its product development resources for iPad to Vietnam, according to a Nikkei report. The Cupertino-based tech giant is collaborating with China’s BYD (OTC:BYDDF), a key iPad assembler, to relocate its new product introduction (NPI) resources to Vietnam. Engineering verification for a new iPad model will begin in mid-February, with availability expected in the second half of the next year.

What is the Future Price of AAPL Stock?

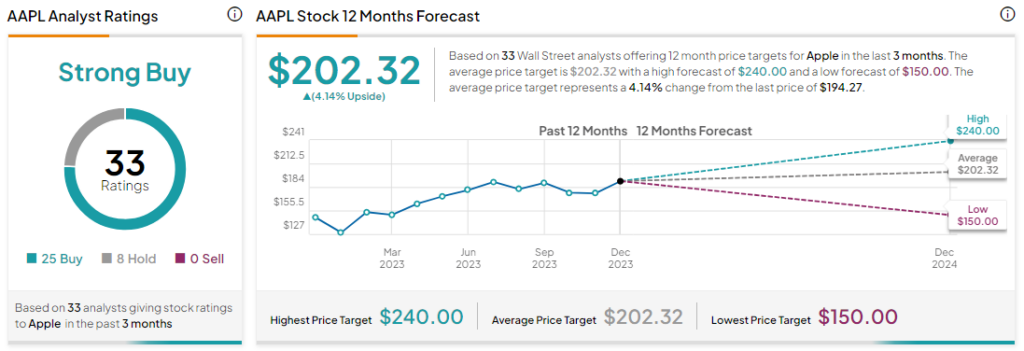

Analysts remain bullish about AAPL stock with a Strong Buy consensus rating based on 25 Buys and eight Holds. Year-to-date, AAPL stock has surged by more than 50%, and the average AAPL price target of $202.32 implies an upside potential of 4.1% at current levels.