Tech giant Apple (AAPL) is delaying the release of a new iPhone Air, which was originally planned for fall 2026. This comes after the first model didn’t sell as well as expected, according to The Information. While there’s no set timeline for the new launch, Apple has already scaled back production of the current model. Notably, the iPhone Air was designed to be Apple’s thinnest phone yet, and the next version was expected to improve on battery life, weight, and cooling. But with weak demand and plenty of unsold units still available, Apple is rethinking its approach.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

This isn’t the first time Apple has struggled to sell new iPhone variants. In fact, previous launches like the iPhone Mini and iPhone 14 Plus also saw poor sales and production cuts shortly after launch. Interestingly, Apple had only allocated 10% of its iPhone manufacturing to the Air model, but even that wasn’t enough to avoid excess inventory. As a result, in September, the iPhone Air accounted for just 3% of total iPhone sales, compared to 9% for the iPhone 17 Pro and 12% for the Pro Max.

In addition, Apple had planned to launch the second-generation iPhone Air next fall, alongside the iPhone 18 Pro and its first foldable phone. Now, the Air has been pulled from the schedule, though it hasn’t been canceled. Instead, engineers are still working on it, and a reworked version could launch as early as spring 2027. Apple is also restructuring its launch strategy by planning to release budget models in the spring and premium models in the fall going forward.

Is Apple a Buy or Sell Right Now?

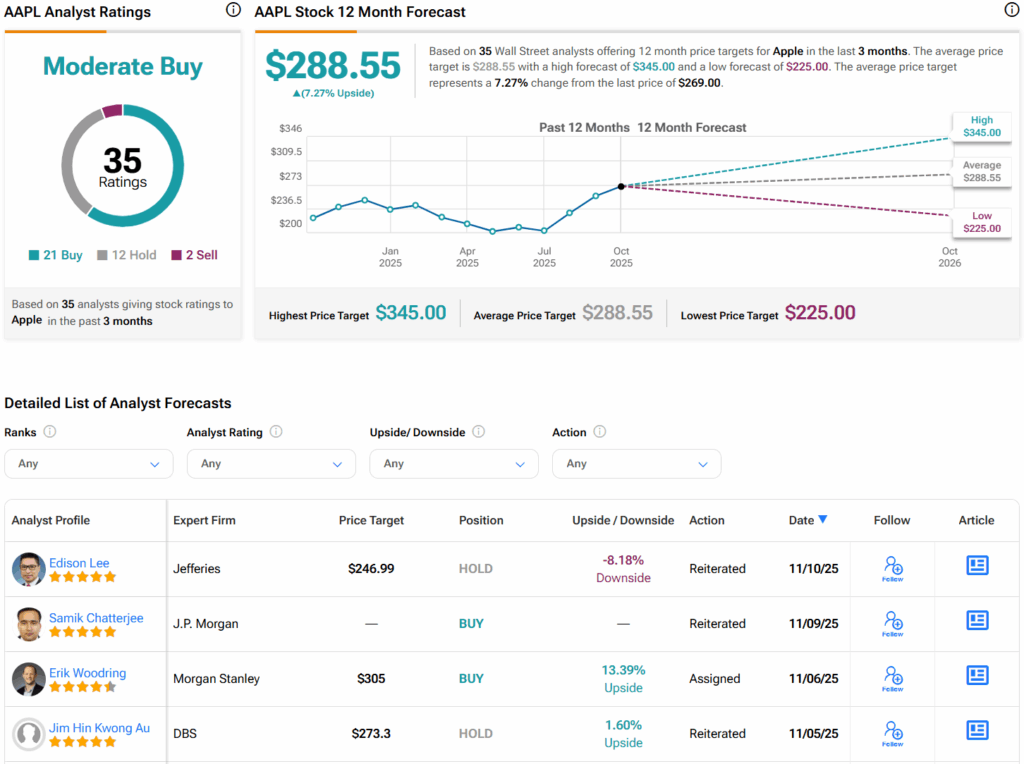

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 21 Buys, 12 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $288.55 per share implies 7.3% upside potential.