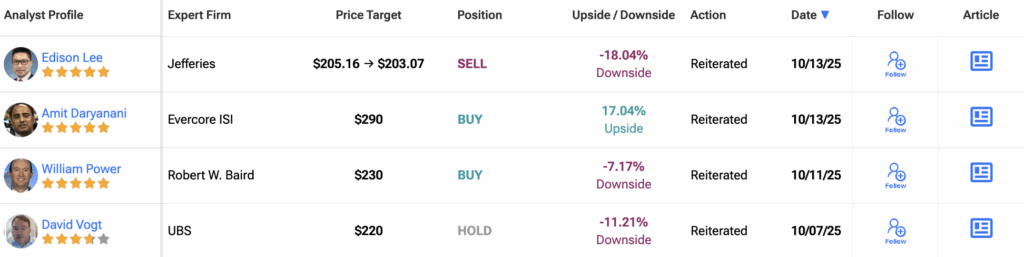

Apple stock (AAPL) came under pressure on Monday after Jefferies (JEF) analyst Edison Lee lowered his price target to $203.07 from $205.16, maintaining an underperform rating on the world’s most valuable company.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The revised target implies a potential 17% drop from Apple’s opening price of around $246. In Lee’s view, Apple’s valuation has become “unattractive,” even with shares down just 2% so far this year.

“There’s simply more downside than upside for Apple,” Lee said in his latest note to clients, citing slowing smartphone momentum and the company’s exposure to trade risks under the Trump administration’s revived tariff strategy.

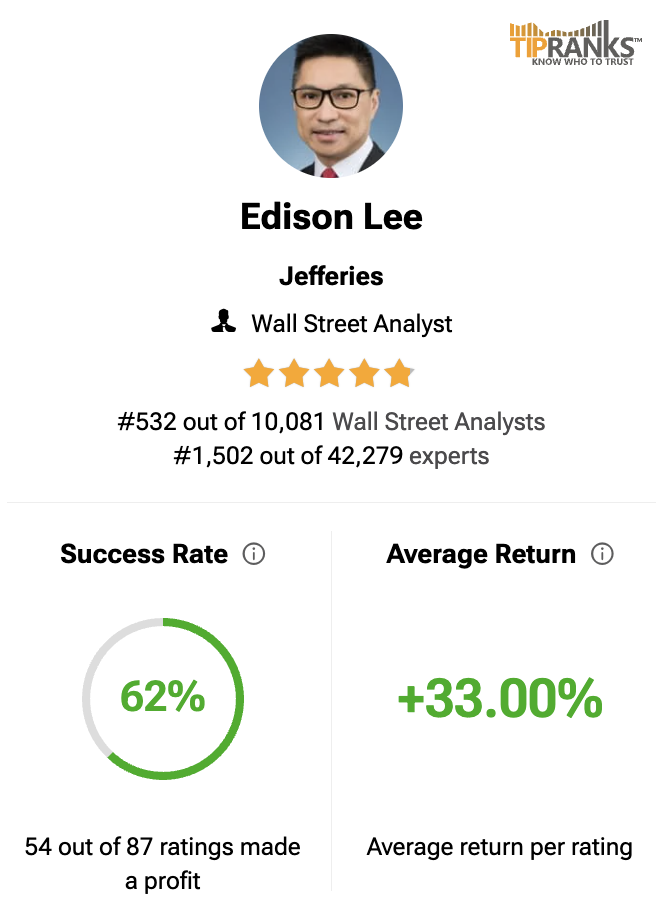

It is worth noting that Lee ranks 532 out of more than 10,081 analysts tracked by TipRanks. He has a success rate of 62%, with an average return per rating of 33% over a one-year timeframe.

Jefferies Warns on iPhone 17 and Tariff Trouble

Lee also raised red flags over Apple’s production strategy for the upcoming iPhone 17, warning that shifting manufacturing from China to India may not be enough to meet U.S. demand.

“As Trump has just slapped an additional 100% (now 30%) tariff on Chinese imports, whether smartphone imports from China would stay exempt is unclear,” he said, adding that Apple’s tariff-exempt status “could come back to haunt AAPL.”

If exemptions are removed, Apple could be forced to expand manufacturing in the United States, a move Lee says would drive costs significantly higher. He also noted that margins on the iPhone 17 may suffer from “rising production costs and an unfavorable product mix,” with early signs that demand is already cooling.

Earlier this month, Jefferies downgraded Apple to underperform, saying the market had “overly lofty expectations” for the company’s next phone cycle.

Apple’s Legal Troubles Add to Pressure

Apple’s challenges extend beyond supply chains and tariffs. The company is now facing a lawsuit from neuroscientists Susana Martinez-Conde and Stephen Macknik, who claim Apple used copyrighted books without permission to train its Apple Intelligence system.

Filed on October 9 in the U.S. District Court for the Northern District of California, the lawsuit alleges that Apple accessed thousands of protected works through “shadow libraries,” including those authored by the plaintiffs themselves.

The researchers argue that Apple’s market cap surged by over $200 billion after revealing its AI system, value they say was “built on stolen content.”

This isn’t Apple’s first AI-related copyright dispute. In September, a group of authors filed a similar lawsuit accusing the company of using copyrighted material in its data training. Other tech firms such as Meta (META) and Anthropic have faced related claims but have leaned on the fair use defense with more success.

What Could Come Next for Apple Stock

The combination of trade headwinds, margin pressure, and legal scrutiny is weighing heavily on sentiment toward Apple. Analysts say the company may need to provide stronger forward guidance or show evidence of an iPhone rebound to restore investor confidence.

Despite these concerns, Apple remains resilient in the broader market. Shares have slipped modestly compared to peers, and long-term investors continue to treat the company as a defensive tech play amid market volatility.

Still, Jefferies’ latest warning highlights a deeper issue, which is that Apple’s supply chain and product strategy are becoming increasingly tied to geopolitical uncertainty. Whether it can maintain its premium valuation may now depend as much on diplomacy and regulation as on innovation.

Is Apple a Good Stock to Buy?

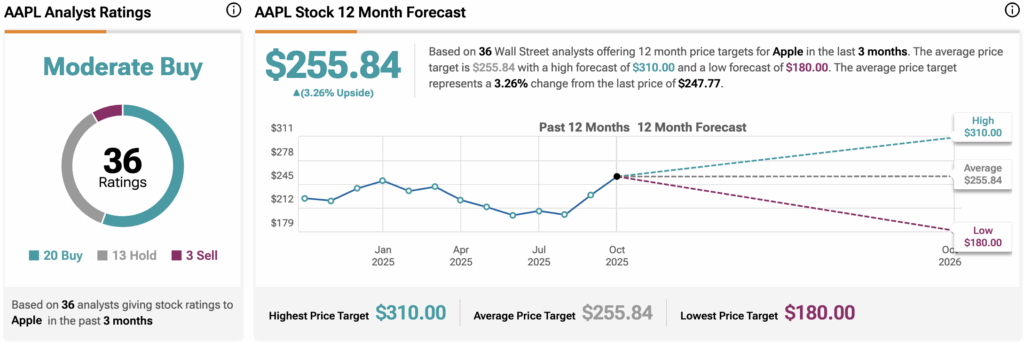

Despite Jefferies’ bearish tone, Wall Street remains cautiously optimistic about Apple’s long-term outlook. Based on data from 36 analysts, Apple holds a “Moderate Buy” consensus rating, with 20 recommending a Buy, 13 suggesting a Hold, and three giving the stock a Sell rating.

The average 12-month AAPL price target stands at $255.84, suggesting a 3.26% upside from the current price.