Apple (NASDAQ:AAPL) is developing chips tailored specifically for running artificial intelligence (AI) software in data center servers, the Wall Street Journal reported. The strategic move will likely enhance Apple’s AI capabilities and position the tech giant well to compete more aggressively in the AI space with Microsoft (NASDAQ:MSFT) and Meta (NASDAQ:META).

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Apple has a solid history of designing cutting-edge chips for its products, including iPhones and Macs. Drawing upon this expertise, the company is now focusing on server technology. Internally, the project is codenamed ACDC (Apple Chips in Data Center), and the company has collaborated with chip maker Taiwan Semiconductor Manufacturing (NYSE:TSM) to advance chip design and production.

While the timeline for unveiling the new chip remains uncertain, Project ACDC has been in progress for several years. Moreover, during the Q2 conference call, Apple said it would soon announce several AI-related developments.

Navigating a Competitive Landscape

Apple’s foray into AI chip development comes amidst intensified competition, as tech giants like Microsoft and Meta pour billions of dollars into generative AI technologies.

Meanwhile, the report highlighted that Apple’s server chip will be focused on executing AI models, with a particular emphasis on inference tasks rather than training AI models, currently dominated by Nvidia (NASDAQ:NVDA). Thus, this will position Apple uniquely within the AI hardware landscape.

Is Apple a Buy, Hold, or Sell?

Apple stock is down about 5.5% year-to-date, reflecting softness in product demand. Moreover, the company has been criticized for lagging its peers in AI advancements.

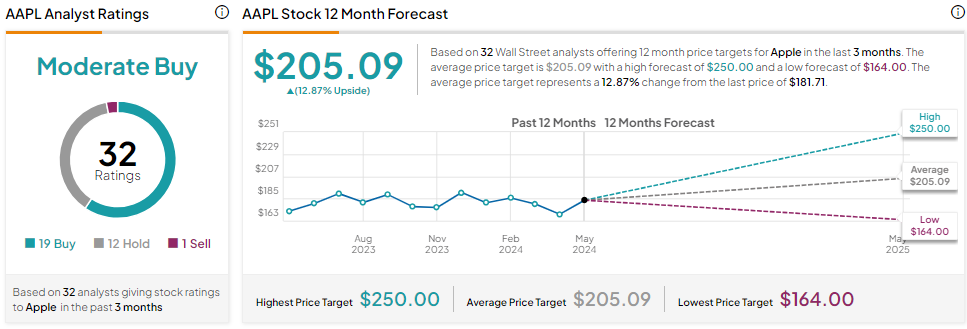

Apple stock sports a Moderate Buy consensus rating based on 19 Buys, 12 Holds, and one Sell recommendation. The analysts’ average price target on AAPL stock is $205.09, implying 12.87% upside potential from current levels.