Apple (NASDAQ:AAPL) supplier Foxconn is rapidly expanding its presence in India. The company is planning to invest at least a billion dollars in a plant it is setting up in the country, according to Bloomberg.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This development comes only weeks after the company earmarked $1.6 billion for a 300-acre facility in Bengaluru, India. The new investment is expected to increase capacity for Foxconn, which has been producing Apple products in India for years now.

The persistent U.S.-China trade tensions seem to be accelerating Apple’s India push. Tata Group, an Indian conglomerate, plans to set up an assembly plant for iPhones. The plant, with nearly 20 assembly lines, is expected to commence operations within 12 to 18 months. Earlier this year, Apple opened its first retail outlet in India and Tata is planning to open nearly 100 Apple-focused outlets in the country.

Moreover, Apple is planning to more than quadruple its India investments to $40 billion and produce nearly a quarter of its iPhones in the country. In the wake of possible rate-cut hints from the U.S. Fed, Apple shares closed at a record $197.96 yesterday. Shares of the company have rallied nearly 36% over the past year,

What Is AAPL’s Price Target?

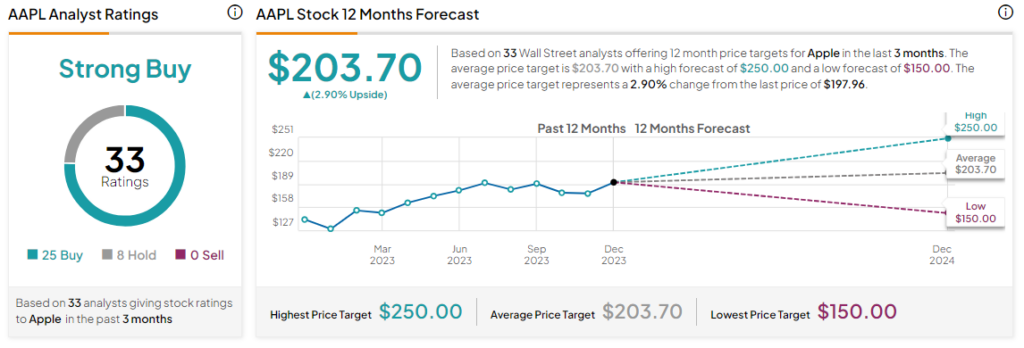

Meanwhile, the Street has a Strong Buy consensus rating on Apple and the average AAPL price target of $203.70 implies a modest 2.9% potential upside in the stock.

Read full Disclosure