The so-called “right to repair” has proven somewhat controversial in a market where products are commonly regarded as disposable goods. But tech giant Apple (NASDAQ:AAPL) has expanded its own line of products that qualify for self-service repairs, giving consumers new options in the market. That didn’t quite sit well with investors, though, as Apple shares were down fractionally in Thursday afternoon’s trading.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Apple’s recent set of changes will add devices powered by the M3 chip—iMacs and MacBook Pro models—to the roster of devices that customers can repair themselves if they’re able to. That means that Apple will make MacBook Pro and iMac technical manuals available for use and open up the supply lines of legitimate Apple parts to end users to replace parts as needed. Apple, not surprisingly, justifies this move by declaring it “..good for the planet,” as well as for users, who can now extend their devices’ useful life spans.

But Is It a Good Time?

Depending on how you interpret this move, it will either limit future sales or endear customers to the brand, keeping them around for longer. This is either welcome news or a further cause for alarm, as it comes out right about the same time we find the Chinese market is further cutting iPhone 15 prices.

Apparently, the Chinese economic slowdown is causing trouble for the Apple market, and several major Chinese retailers are offering steep discounts for anyone who will buy an iPhone 15. Given that it’s only been five months since the launch of said device, that suggests sales have just about topped out in the region, and that could be a problem for Apple in the near term.

Is Apple a Buy, Hold, or Sell?

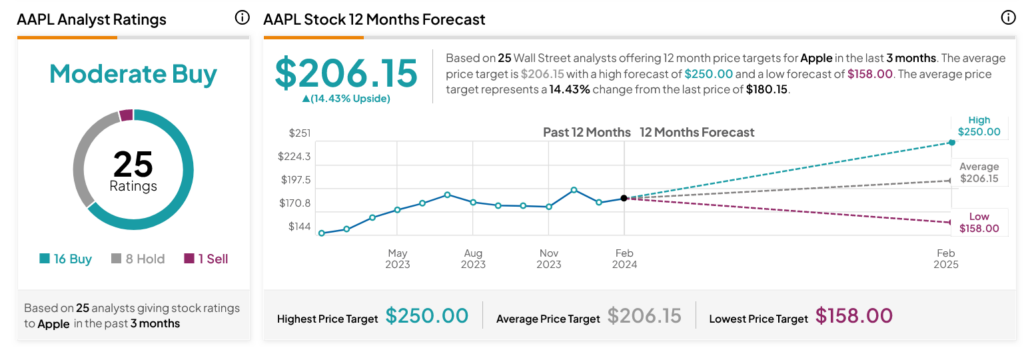

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 16 Buys, eight Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 24.03% rally in its share price over the past year, the average AAPL price target of $206.15 per share implies 14.43% upside potential.