The Apple Watch ban is now off, at least for the time being. But you wouldn’t believe it by looking at Apple’s (NASDAQ:AAPL) investors, who pulled back on the reins and sent Apple shares down fractionally in Wednesday afternoon’s trading session.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Just yesterday, we heard about how Apple was taking its case before an appeals court to get the ban on Apple Watch sales and imports temporarily halted. The reasons then were sound enough: Apple had a new version of the disputed blood oxygenation sensor in the works and wanted to run it by the International Trade Commission first to see if that passed patent muster.

That was good enough for the appeals court, who gave Apple a stay until somewhere around January 10, the latest that the ITC can respond to the new move from Apple. That puts the devices back in play for one of Apple’s busiest buying seasons of the year, which is good news given how much cash Apple derives from wearable tech.

And Then, More Trouble Arrived

Fix one problem, and then another one shows up. It’s the way of the world, isn’t it? And it’s exactly what Apple is facing right now in the form of a major new competitor gearing up to take Apple on. Apple will be losing Tang Tan, one of its leading design executives, to former Apple design leader Jony Ive, who started his own operation, LoveFrom. Tan will be out of Apple in February, and by joining LoveFrom, Tan may be designing devices that tackle Apple’s markets directly. Reports note that LoveFrom is already working on some home device projects.

What is the Future Price of Apple Stock?

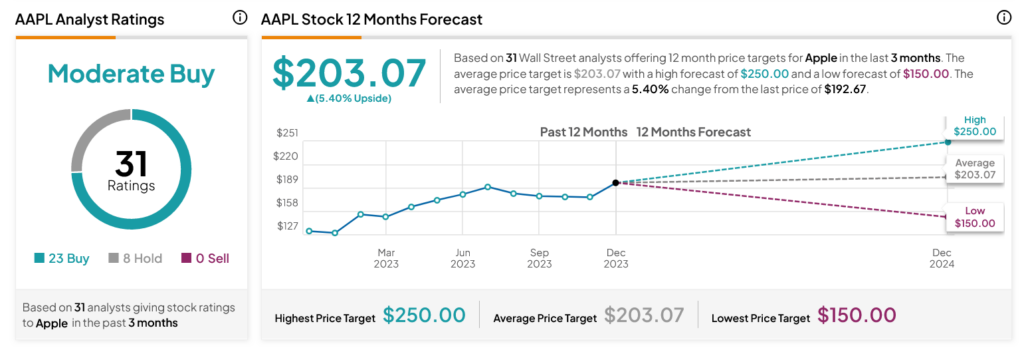

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 23 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. After a 53.69% rally in its share price over the past year, the average AAPL price target of $203.07 per share implies 5.4% upside potential.