Analysts at Bank of America said Apple’s (NASDAQ:AAPL) licensing and subscription services revenue will drive sales growth. However, the analysts warned the multinational technology company risks some exposure to the ongoing antitrust case against Google (NASDAQ:GOOG) (NASDAQ:GOOGL) and may face litigation itself.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

BofA said Apple’s Safari payments have been the major contributors to its licensing revenue. The analyst noted that the revenue from the payments made up 75% of the total revenue generated from licensing in 2023.

However, the firm noted that the revenue from the licensing segment has been slowing down in 2023. It predicted an 8% year-over-year increase in services revenue in 2023, compared to 16%, 27%, and 14% growth in 2020, 2021, and 2022, respectively. In addition, they predicted that Ad revenue should contribute a more significant share going forward.

Furthermore, Bank of America pointed to Apple’s iCloud and AppleCare+ as the largest revenue contributors among its subscription services. The firm also predicted an increase in subscription revenues in the coming years, with an estimated $34.6B by 2025.

Despite this optimism, the firm warned the antitrust case against Google by the DoJ carries a risk of litigation against Apple. Per details of the case, regulators are looking into Google’s payments to Apple as well as other device makers and wireless carriers.

Even though Google hailed its service as one of the best around, the regulators are not buying it. Instead, they alleged that Google’s contracts to ensure its search engine is the top choice on most mobile devices suggest the possibility of foul play and is illegal.

However, in support, Eddy Cue, a top Apple executive, testified last month that the statements by Google are an accurate description of its search engine. Cue mentioned that the search engine is the best option for consumers, evidenced by the fact even Apple, which prefers to keep its ecosystem closed, uses it across its devices.

Is Apple Stock Expected to Rise?

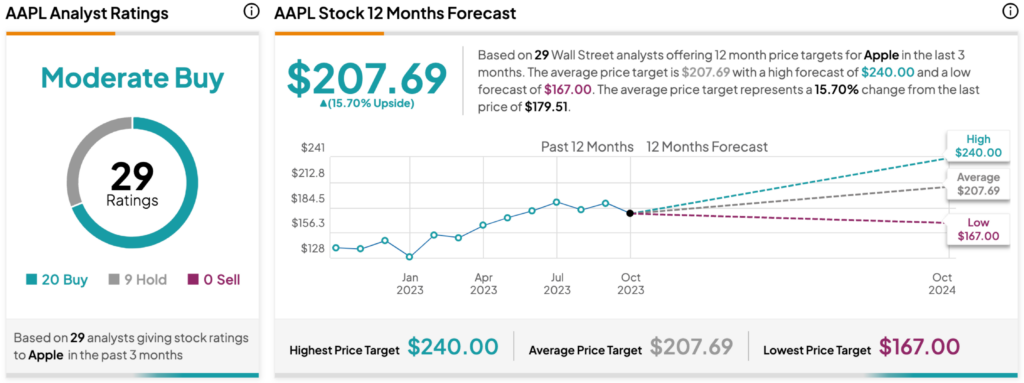

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 20 Buys, nine Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Nevertheless, the average Apple price target of $207.69 per share implies a 15.70% upside potential.