Shares of tech giant Apple (NASDAQ:AAPL) are up at the time of writing as the iPhone 15 hit the market, catching the eager eyes of Wall Street analysts. Dan Ives from Wedbush Securities observed strong demand for the iPhone 15 Pro and Pro Max, noting especially enthusiastic consumers in China, Europe, and the U.S. Ives also mentioned his optimism about the product’s sales, hinting at possible shipments of up to 90 million units due to remarkable carrier promotions.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

However, Wamsi Mohan of Bank of America offers a less enthusiastic perspective. He suggests that the carrier incentives mirror those from the previous year, making it unlikely they’d significantly boost sales. Mohan also highlights the potential hidden costs to customers, even if phones are marketed as cost-free. For instance, under specific conditions, upfront payments could reach a hefty sum, especially for the iPhone 15 Pro Max. Mohan maintains a neutral stance on Apple’s stock.

Is AAPL Stock a Buy?

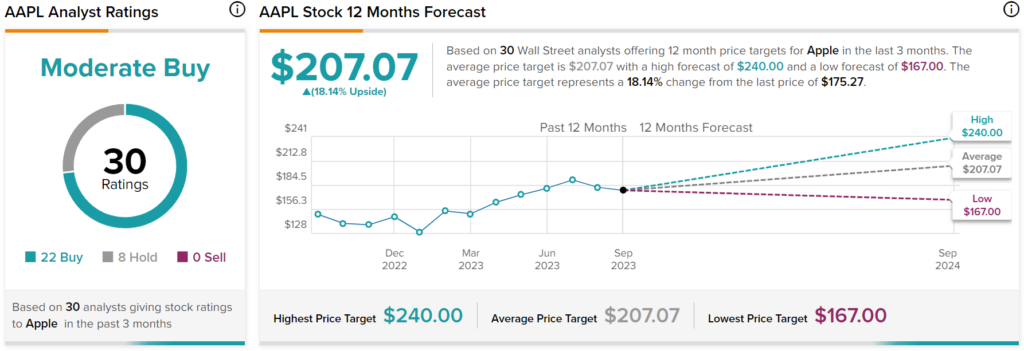

Overall, analysts have a Moderate Buy consensus rating on AAPL stock based on 22 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic above. Furthermore, the average price target of $207.07 per share implies 18.14% upside potential.