Tech giant Apple (NASDAQ:AAPL) has been having a rough go of things lately. It’s been pushing its artificial intelligence (AI) ambitions hard, pouring millions of dollars per day into the project. Troubles in China have also battered the stock. But today, things turned around just a bit for Apple as Morgan Stanley stepped in with some positive commentary that helped the stock tick higher.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Word from Morgan Stanley, via analyst Erik Woodring, noted that the odds of the Chinese ban on iPhones spreading much beyond the government were “unlikely.” Further, Woodring noted that the market has been overreacting to this point, especially in regards to the Huawei Mate 60 Pro smartphone, built around Huawei’s homemade chip. Woodring referred to that phone as “more bark than bite.” Nevertheless, Woodring did get cautious at one point, noting that losing China as a market meant a potential loss of around $30 billion in operating profit.

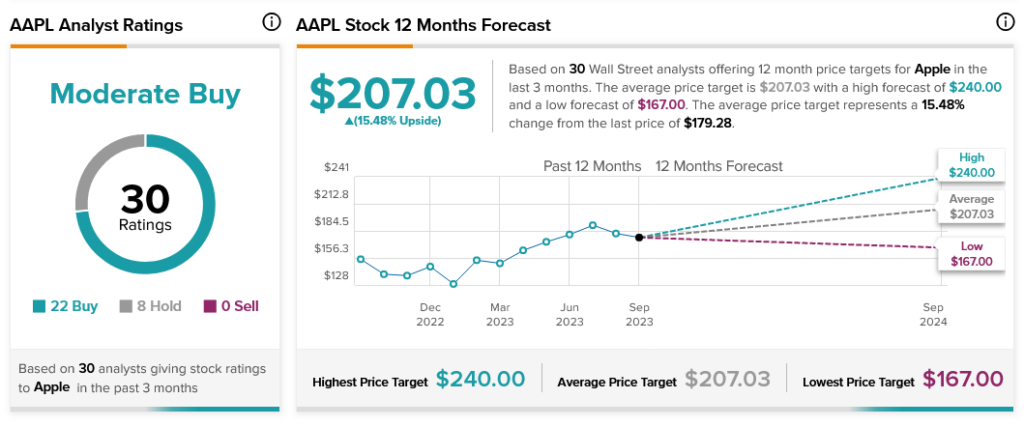

Meanwhile, analysts are largely sticking with Apple. With 22 Buy ratings and eight Holds, Apple stock is considered a Moderate Buy by analysts. Further, Apple stock comes with 15.48% upside potential thanks to its average price target of $207.03.