It’s been a busy few days for Apple (NASDAQ:AAPL) already, and it’s on track to get even busier. Apple is planning to take a couple legal fights back to the European Union after settling some other issues. Apple now plans to launch appeals for the European Union’s decision to place the entirety of Apple’s App Store into a newly created digital antitrust list, part of the EU’s efforts in the Digital Markets Act.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Further, Apple also plans to appeal the EU’s plans to subject Apple’s iMessage systems to further consideration. The appeals are still being put together, so any immediate plans may change before they actually see a courtroom.

This is only a portion of the legal issues that Apple has encountered of late, but it doesn’t seem to be doing much to its ability to pursue business, thankfully. However, it’s got some troubles from its latest iOS update. Users of Apple’s wildly popular iPhone device are noting that the 17.1.1 update is doing terrible things to their battery life.

Some report their fully-charged devices are losing power within mere hours, a serious problem for anyone who can’t charge their phones daily. Some reports suggest that this may be a problem that fixes itself. Ultimately, some battery issues can simply be a matter of the device “recalibrating” the battery, which not only consumes power but also makes it look like the device is drawing power unduly.

Is Apple a Buy, Hold, or Sell?

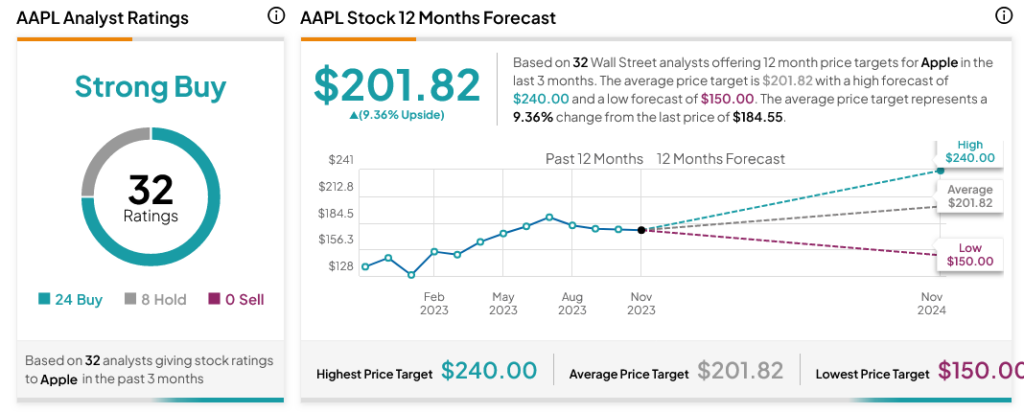

Turning to Wall Street, analysts have a Strong Buy consensus rating on AAPL stock based on 24 Buys and eight Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $201.82 per share implies 9.36% upside potential.