With the Department of Justice (DoJ) in the United States once again taking aim at Google (NASDAQ:GOOG), there might be one somewhat less-expected loser in any negative verdict for Google: Apple (NASDAQ:AAPL). The word came out of Bernstein via analyst Toni Sacconaghi, who noted, “A negative ruling for Google would likely be a downside catalyst for Apple.” Why? Simple; the deal between Apple and Google—referred to as the Information Services Agreement—represents a hefty chunk of Apple’s bottom line.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

In fact, Sacconaghi also highlighted that the deal is worth somewhere between $18 billion and $20 billion a year. Worse, for Apple, it represents a whopping 14% to 16% of its total operating profits. Losing that agreement—which it might, if the DoJ calls for it—would be a serious blow.

Meanwhile, Apple actually had an opportunity to go a different route previously. Recent testimony in the Google case from the founder of the DuckDuckGo search engine, Gabriel Weinberg, revealed that DuckDuckGo had been in talks with Apple about a potential contract to become Apple’s default search engine. However, Google—and its massive multi-billion dollar paydays—were just too much for Apple to pass up.

Is Apple Stock a Good Buy Right Now?

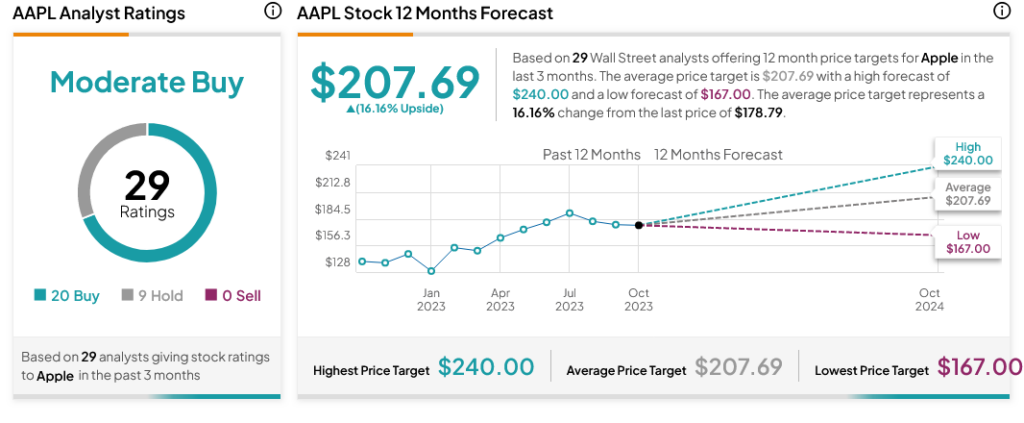

Meanwhile, Apple still enjoys plenty of analyst support. With 20 Buy ratings and nine Holds, Apple stock rates as a Moderate Buy by analyst consensus. Meanwhile, Apple stock also offers 16.16% upside potential thanks to its average price target of $207.69.