For most, the idea that iPhone 15 basic and Pro models are more available than ever would sound like good news. No risk of them running out before you pull the trigger on that purchase, right? Well, it’s not so good for Apple (NASDAQ:AAPL), who dropped fractionally on the recent report from Bank of America that it’s easier than usual to find one of Apple’s latest devices.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The report from Bank of America, as expressed by analyst Wamsi Mohan, noted that in pretty much every geographical sector around, iPhone 15 availability was up. Even Europe, where availability was the weakest, stood at 7% available. Meanwhile, in Canada, the United States, China, and Asia outside of China, iPhones were available in a range between 20% and 30%. Essentially, Mohan noted, the key issue here wasn’t a lack of demand but rather an improving supply environment where stuff people want actually gets to shelves to be purchased.

Meanwhile, Apple went on a bit of a charm offensive in China, sending out CEO Tim Cook to do some meet and greets at an Apple store in Chengdu. Cook showed up to spectate some “Honor of Kings” matches, as he declared the game a “…global phenomenon on the App Store.” But Cook’s visit wasn’t all about mobile gaming; a farmer in Sichuan showed off how he used an iPad to improve his farm, and an elementary school in Yucheng District showed off their iPad prowess for everything from flying drones to creating software.

Is Apple a Buy or Sell Today?

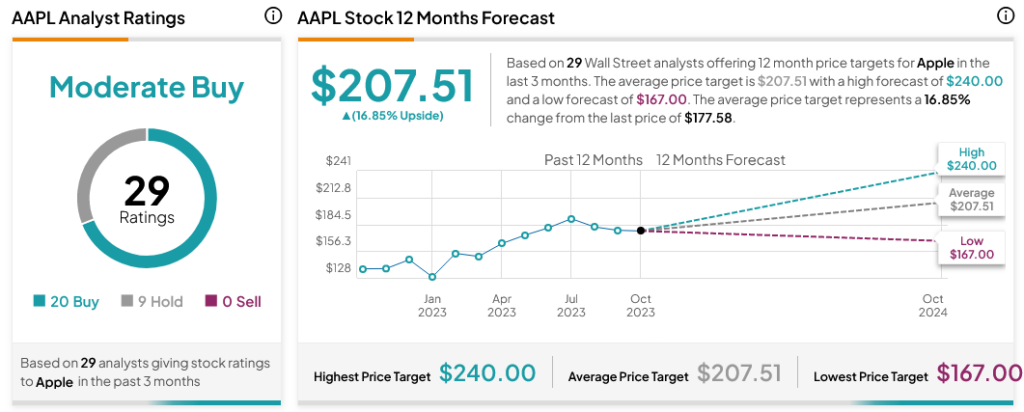

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AAPL stock based on 20 Buys and nine Holds assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $207.51 per share implies 16.85% upside potential.