Shares of tech titan Apple (NASDAQ:AAPL) are trading lower today, which may be attributed to analyst comments. Interestingly, Laura Martin of Needham reiterated her Buy rating while assigning a price target of $220 per share. However, she cut Q2 estimates due to issues in China and slumping iPhone sales.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

Martin now expects sales and earnings per share to come in at $90.8 billion and $1.51, respectively. Compared to her prior forecast, the updated figures are 4% lower for the former and 7% lower for the latter. She believes that Apple’s growth outlook is “anemic” and that its expenses will rise as the firm boosts investments in artificial intelligence.

Is Apple a Buy, Hold, or Sell?

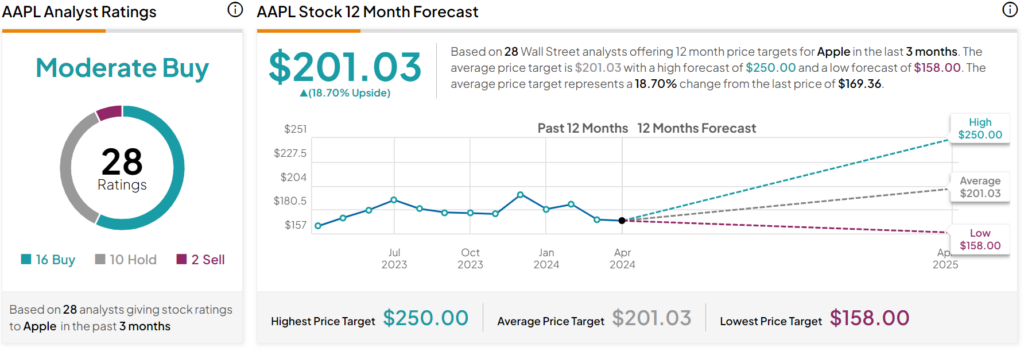

Overall, analysts have a Moderate Buy consensus rating on Apple stock based on 16 Buys, 10 Holds, and two Sells assigned in the past three months, as indicated by the graphic below. After a 12% year-to-date decline, the average AAPL price target of $201.03 per share implies 18.7% upside potential.

Is It Wise to Allocate $1,000 Toward AAPL Stock Right Now?

Before you hurry to invest in AAPL, think about the following:

TipRanks’ team has built the Top Stocks Portfolio for investors, and Apple is not included. Our portfolio highlights companies that have been hand-picked for their potential to deliver significant gains in the years ahead.