Consumer electronics giant Apple Inc. (NASDAQ:AAPL) recently revealed that the company would begin manufacturing the new iPhone in India earlier than its previous models. The move is aimed at reducing dependence on China amid the country’s zero-tolerance COVID policy and geopolitical tensions between the U.S. and China.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Apple is Looking to Diversify its Manufacturing Base

Apple’s India manufacturing accounted for 3.1% of its global base, up from 1.3% in 2020. It is expected to further rise to 5%-7% this year as China’s strict anti-COVID policy has exposed the company to supply chain bottlenecks.

Apple plans to start producing the upcoming iPhone 14 model in India as early as November, just a few months after its official release. Notably, the company has already disclosed that its iPhone 13 series phones will be manufactured in April.

Although 90% of Apple products are still manufactured in China, the company is looking to lessen its dependence on the South Asian giant. India, meanwhile, has emerged as an attractive alternative with a more open and predictable regulatory regime and a simpler corporate tax structure.

Notably, the new iPhone models to be manufactured in India will be for domestic consumption as well as export.

Strong Website Traffic Points Towards Apple’s Sustained Growth

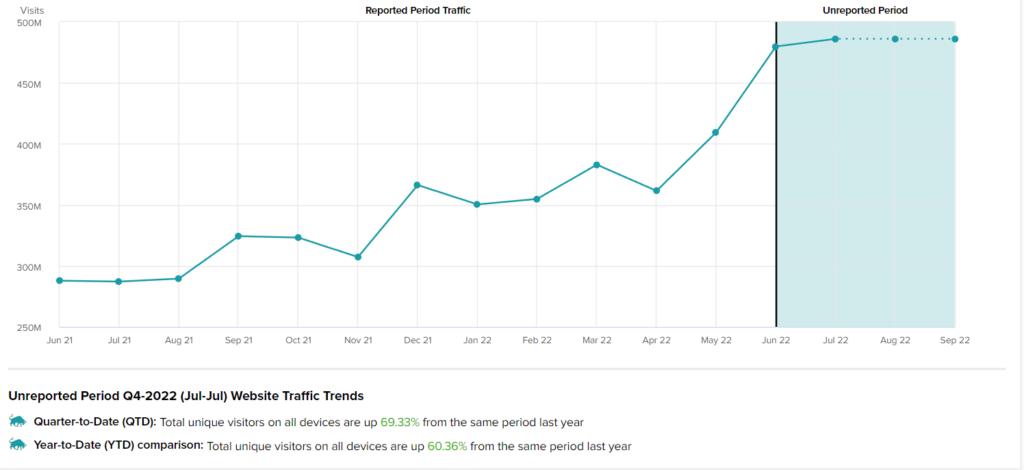

Apple’s robust website traffic growth is an indicator of the company’s strong demand.

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (SEMR), the world’s biggest website usage monitoring service, offers insight into Apple’s performance this quarter.

According to the tool, the Apple website recorded a 69.33% monthly rise in global visits in July, compared to the same period last year. Moreover, year-to-date, Apple website traffic increased by 60.36%, compared to the previous year.

Learn how Website Traffic can help you research your favorite stocks.

Is Apple a Buy or Sell Now?

Overall, the consensus among analysts for Apple stock is a Strong Buy based on 23 Buys, four Holds, and one Sell. The average AAPL price target of $183.07 implies an upside potential of 9.5% from current levels. Shares have gained 11.8% over the past year.

Key Takeaways

As tensions between China and the U.S. escalate, Apple looks to hedge its manufacturing activities. India, with its large domestic market and export capabilities, presents a viable alternative for the tech giant. Although complete independence from China in terms of manufacturing remains a distant dream, a gradual shift towards a more open country like India can allow Apple to diversify its manufacturing base.

Read full Disclosure