Apple (NASDAQ:AAPL) has agreed to a $490 million settlement to resolve a class-action lawsuit. CEO Tim Cook faced allegations of shareholder fraud related to allegedly concealing a drop in iPhone demand in China. The preliminary settlement was filed in the U.S. District Court in Oakland and is currently pending approval from Judge Yvonne Gonzalez Rogers

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

First Reduction of Apple Revenue Forecast Since 2007

The class action lawsuit stemmed from AAPL’s surprise announcement on January 2, 2019, where the tech giant slashed its revenue forecast due to trade tensions between the U.S. and China. In a previous call with analysts, Apple’s CEO Tim Cook noted that while Apple’s sales were affected in countries like Brazil, India, Russia, and Turkey due to currency devaluation, he stated, “I would not put China in that category.”

This marks the first instance since its 2007 iPhone debut that Apple has issued a reduced revenue forecast. Subsequently, a 10% decline in Apple’s stock value occurred the following day, resulting in a loss of $74 billion in market capitalization. Investors who acquired Apple shares between Cook’s remarks and the adjusted revenue outlook are directly impacted by this change.

Apple has denied liability but has settled the lawsuit to avoid litigation costs. Meanwhile, AAPL has enhanced its AI capabilities with the acquisition of Canadian Artificial Intelligence (AI) startup DarwinAI earlier this year.

What is the Apple Stock Price Forecast for 2025?

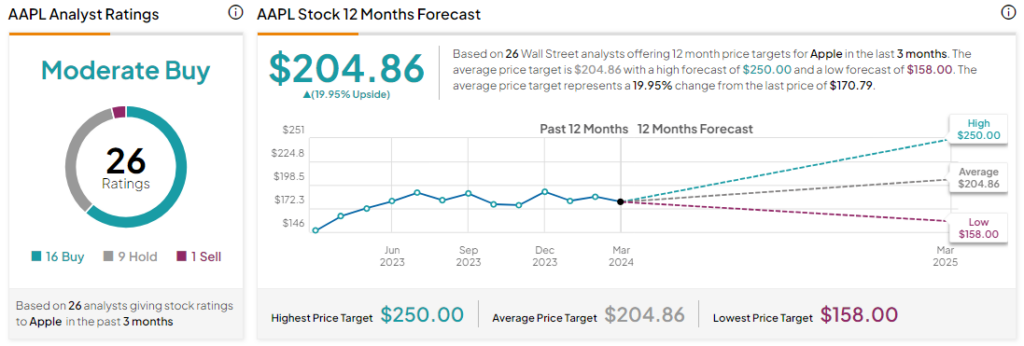

Analysts remain cautiously optimistic about AAPL stock, with a Moderate Buy consensus rating based on 16 Buys, nine Holds, and one Sell. Over the past year, AAPL stock has gained by more than 10%, and the average AAPL price target of $204.86 implies an upside potential of 19.9% at current levels.