Tech giant Apple Inc. (NASDAQ:AAPL) will no longer be using memory chips from China’s leading memory chipmaker Yangtze Memory Technologies Co. (YMTC) in its product offerings, according to the Nikkei.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

Earlier, Apple intended to use NAND flash memory chips made by YMTC for its iPhones to be sold in China. Further, it had planned to buy 40% of its chip requirements for iPhones from YMTC.

The company’s move is a direct result of the Biden administration’s export control rules against semiconductor and technology companies in China.

Last week, the U.S. government added YMTC as well as 30 other Chinese companies to the list of companies that U.S. officials have not been able to review.

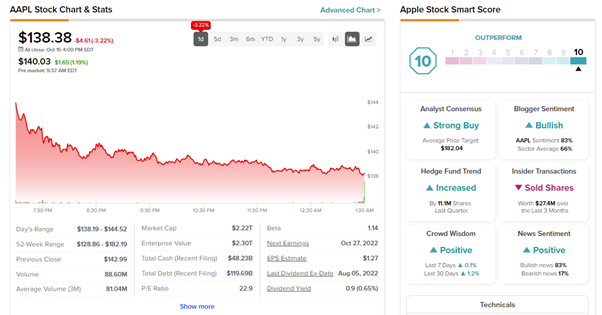

Meanwhile, Credit Suisse analyst Shannon Cross decreased the price target on Apple to $190 (37.3% upside potential) from $201 but reiterated a Buy rating.

Apple is scheduled to report its Q4 earnings on October 27. Ahead of the results, Cross is bullish on the iPhone 14 Pro momentum, which she thinks has gained from robust demand as well as a mix shift to Pro and Pro Max models.

Consequently, she has raised her revenue estimates for the upcoming Q4 by 1% to $89.68 billion. Further, her EPS estimates are now higher by $0.04 per share to $1.30. Both her estimates are ahead of the consensus numbers.

Longer term, however, Cross has lowered her estimates based on a lackluster consumer spending scenario.

Is Apple a Buy or Sell Now?

The Wall Street community is clearly optimistic about Apple stock. Overall, the stock commands a Strong Buy consensus rating based on 23 Buys, four Holds, and one Sell. Apple’s average price target of $182.04 implies 31.55% upside potential from current levels.

Further, AAPL stock has a top-notch Smart Score of a “Perfect 10” on TipRanks, indicating that the stock has strong potential to outperform market expectations.

Read full Disclosure