Shares of Apple (NASDAQ: AAPL) were down in pre-market trading on Thursday after Bank of America analyst Wamsi Mohan downgraded the stock to a Hold from a Buy and slashed the price target to $160 from $185, while also lowering FY23 estimates.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The analyst commented in his research note to clients, “We see risk to this outperformance over the next year, as we expect material negative [estimates] revisions driven by weaker consumer demand (Services already in slowdown and we expect products to follow).”

The top-rated analyst also lowered his FY23 revenue estimates to $379 billion and earnings of $5.87 per share.

What is a Good Buy Price for AAPL?

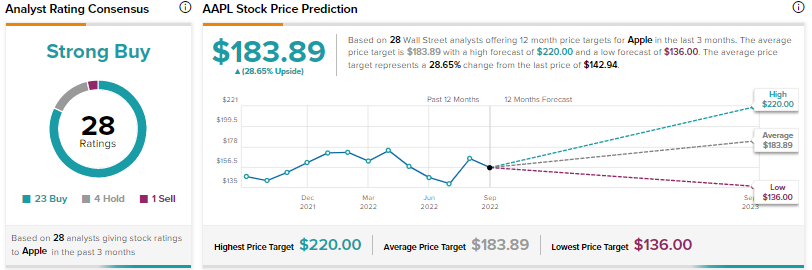

Wall Street analysts are bullish about AAPL with a Strong Buy consensus rating based on 23 Buys, four holds, and one Sell. The average price target for AAPL stock is $183.89 implying an upside potential of 28.6%.