On Monday, Bloomberg reported that Apple (NASDAQ: AAPL) could experience a shortfall of around 6 million iPhone Pro units this year due to the unrest at the Zhengzhou manufacturing hub in China. This manufacturing facility is operated by AAPL’s iPhone supplier, Foxconn.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The Zhenghou Foxconn plant has been facing one challenge after another including COVID-related disruptions and was further hurt by violent protests by workers last week due to delayed bonus payments. Employees had earlier expressed their disappointment over the working conditions at the plant amid stringent COVID restrictions.

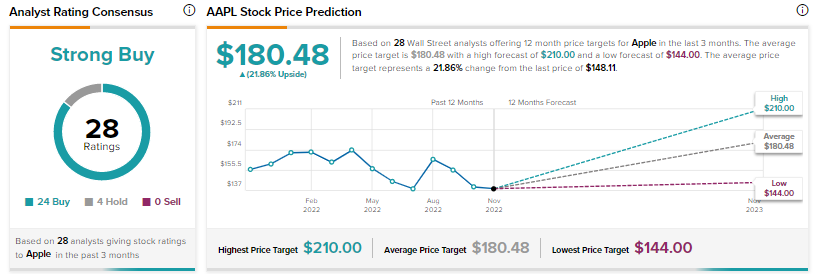

However, analysts continue to be bullish about AAPL stock with a Strong Buy consensus rating based on 24 Buys and four Holds, as indicated by the above graphic.