Apple (AAPL) and Samsung (SSNLF) are engaged in a high-stakes battle to win the top spot in the multi-billion-dollar smartphone market. Both companies are rapidly innovating, launching faster, sleeker, and more customer-friendly versions of their flagship smartphones to sway the markets.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Samsung S25 Edge vs. iPhone 17 Air

Yesterday, Samsung unveiled its slimmest smartphone to date, the Samsung Galaxy S25 Edge, loaded with advanced artificial intelligence (AI) features. Samsung is rolling out the S25 Edge in South Korea on May 23, and in the U.S. on May 30, followed by a global rollout later. The timing of Samsung’s launch remains impeccable, months before Apple is expected to launch its slimmest smartphone to date this fall, dubbed iPhone 17 Air.

Apple’s upcoming smartphone is expected to sport an ultra-thin design and inbuilt with Apple’s inhouse modem chip. Interestingly, Apple is gearing for its 20th anniversary in 2027, which promises to bring along a fresh look to the iPhone along with newer versions. According to Bloomberg’s Mark Gurman, Apple is planning on launching a “mostly glass, curved iPhone” with no display cutouts. Apple is also expected to introduce its first foldable iPhone in 2027 as well as its first smart glasses to compete with Meta Platforms (META) Ray-Bans, making significant progress in its product offerings.

There’s so much to look forward to from Apple in the coming years, and Samsung will definitely not sit quiet. Although, Samsung could very well gain a larger market share through its strategically timed launch of S25 Edge this year, the future could be in Apple’s hands.

A Tight Race in Global Smartphone Market Share

Data from Counterpoint Research showed that in Q1FY25, Samsung had a 20% global share in the smartphone market, while Apple was lagging behind with a 19% share. Consumer’s priorities in phone selection often center around the phone’s performance, camera quality, and storage space. Consumers also view battery life and device heating as top considerations while making the purchase.

Both Apple and Samsung could be impacted by U.S. President Donald Trump’s tariffs. Apple is strategically shifting its manufacturing reliance from China to India and other Asian countries, while Samsung already has a more diversified base in Vietnam and India. Experts predict that smartphone prices could shoot up by 40% to 50% considering the full impact of tariffs. However, Trump recently announced a trade deal with China, which could ease these concerns.

Is Apple a Good Stock to Buy Right Now?

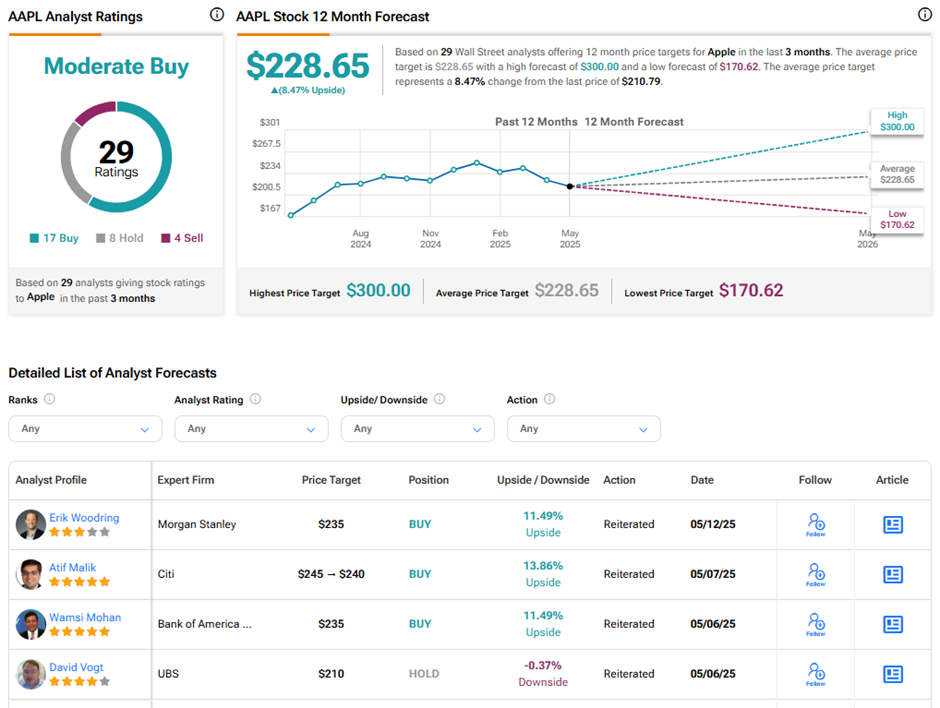

On TipRanks, AAPL stock has a Moderate Buy consensus rating based on 17 Buys, eight Holds, and four Sell ratings. Also, the average Apple price target of $228.65 implies 8.5% upside potential from current levels. Year-to-date, AAPL stock has lost 15.7%.