For the first time, the tech giant Apple Inc. (NASDAQ: AAPL) has allowed outside payments within its App Store’s apps, to abide by a Dutch ruling, Bloomberg reported. The country’s Authority for Consumers and Markets (ACM) gave a deadline to Apple for complying with the order by January 15 or to face fines equal to approximately $57 million.

As a result, the company agreed to allow developers of dating apps in the Netherlands to implement their own third-party payment services to their users.

Background

According to the market regulator, dating app developers were instructed to exclusively use Apple’s in-app payment system. For use of its system, Apple charged commissions of 15%-30% on digital goods purchases. Though Apple’s practices are under regulators and lawmakers’ scrutiny worldwide, the Dutch ruling is applicable in the Netherlands and only for dating apps.

Complying with the decision, Apple said it will introduce “two optional new entitlements exclusively applicable to dating apps on the Netherlands App Store that provide additional payment processing options for users.”

“Dating app developers using these entitlements will need to submit a separate app binary for iOS or iPadOS that may only be distributed in the Netherlands App Store,” the company said.

According to Apple, the recent change will not provide any gains to the local economy, as most developers who are selling dating apps are based outside the Netherlands.

Meanwhile, the company warned developers that since it “will not be directly aware of purchases made using alternative methods, Apple will not be able to assist users with refunds, purchase history, subscription management, and other issues encountered when purchasing digital goods and services through these alternative purchasing methods.”

Appeal

Though Apple has complied with the Dutch ruling, it disagrees with the decision and plans to appeal. The company said, “Because we do not believe these orders are in our users’ best interests, we have appealed the ACM’s decision to a higher court. We’re concerned these changes could compromise the user experience, and create new threats to user privacy and data security.”

Wall Street’s Take

Having a bullish stance on Apple, recently, Piper Sandler analyst Harsh Kumar maintained a Buy rating on Apple and increased the price target to $200 (15.56% upside potential) from $175.

Kumar said, “We believe Apple has a favorable set-up for 2022. We believe iPhone momentum will continue due to 5G adoption, particularly in the United States and China. In addition, we see growth in services and wearables offsetting some of our growth concerns in Mac and iPads.”

Consensus among analysts is a Strong Buy based on 22 Buys, 4 Holds, and 1 Sell. The average Apple stock forecast price of $179.42 implies 3.67% upside potential from current levels. Shares have gained 37% over the past year.

Website Traffic

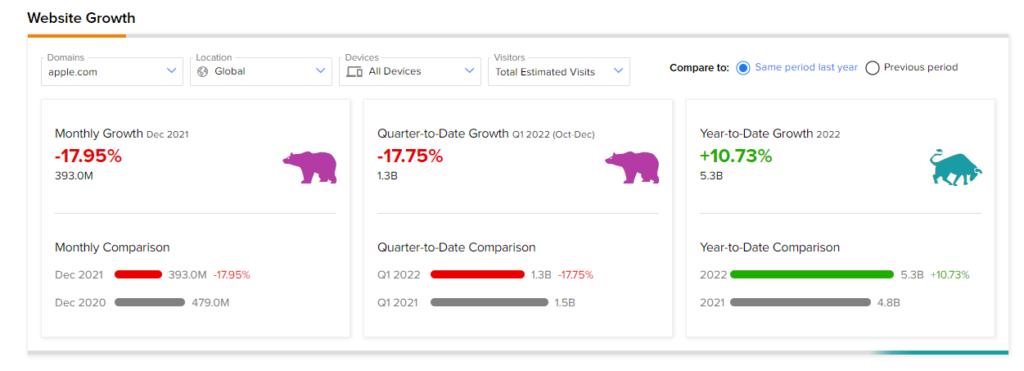

TipRanks’ Website Traffic Tool, which uses data from SEMrush Holdings (NYSE: SEMR), the world’s biggest website usage monitoring service, offers insight into Apple’s performance this quarter.

According to the tool, the Apple website recorded a 17.95% decrease in global visits in December compared to the same period last year. Also, a quarter-to-date comparison showed a fall of 17.75% compared to Q1 2021, while year-to-date website traffic growth stands at 10.73%.

Download the TipRanks mobile app now

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Read full Disclaimer & Disclosure

Related News:

Delta Rises 2% on Upbeat Q4 Results, Warns of Q1 Loss

Ford’s Market Cap Crosses $100B

Virgin Galactic Plunges 19% After Raising $500M in Convertible Debt