Apple Inc. (AAPL), the smartphone powerhouse, is edging closer to a $4 trillion market valuation after its shares climbed 6% following an Oct. 20 report from Counterpoint Research. The report revealed that the iPhone 17 has outperformed its predecessor, the iPhone 16, during its first 10 days on the market. The bullish impetus has since cooled, with AAPL stock now trading around the $257 level.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The new model appears to have resolved several key technological issues that users had raised in recent years, reaffirming Apple’s reputation for innovation. The iPhone 17 lineup is also showing strong momentum in China—one of Apple’s most critical markets. Despite these encouraging trends, I remain Neutral on Apple stock, as I believe its current valuation already reflects the company’s underlying economic fundamentals.

iPhone 17 Gets Off to a Great Start

According to Counterpoint Research, Apple’s iPhone 17 series has achieved 14% higher sales than the iPhone 16 lineup during its first 10 days of availability in the U.S. and China—two of the company’s most critical markets. In China, the base iPhone 17 has emerged as the top seller, while in the U.S., strong demand for the iPhone 17 Pro Max has driven sales growth. Adding to the positive momentum, Apple’s eSIM-only model, the iPhone Air, recently received regulatory approval in China, with pre-orders beginning on October 17.

The iPhone 17’s robust early performance in China is particularly significant, given the company’s recent struggles. In Fiscal 2024, Apple reported an 8% year-over-year decline in China sales to $67 billion, followed by a further 4% drop in the first nine months of 2025.

The company has been losing ground to domestic competitors such as Huawei, Vivo, and Xiaomi (XIACF)—each gaining market share at Apple’s expense. From Q1 2024 to Q2 2025, Apple’s share of smartphone shipments fell by 100 basis points, while Huawei, Vivo, and Xiaomi gained 100, 300, and 200 basis points, respectively. The iPhone 17 series could help Apple reverse this trend and regain lost momentum in China during the current quarter.

Apple’s Pivot to Innovation is Promising

One of the main reasons I’m taking a neutral stance on Apple is the tech giant’s lackluster innovation pipeline. This lack of innovation was arguably one of the main reasons behind the company’s market share losses in China. According to Canalys analyst Lucas Zhong, Chinese consumers look for longer battery life, lighter designs, and AI-powered user experiences when they are purchasing a new smartphone.

Meanwhile, Apple Intelligence, the company’s AI product suite, is not available in China due to regulatory barriers. Expectations are for these features to be rolled out in China later this year. However, even if these expectations come to fruition, there is no denying that Apple Intelligence significantly lags the AI experiences offered by local smartphone manufacturers such as Huawei. Apple has its work cut out to close this technological gap in the coming months to avoid losing further market share to local competitors.

What is encouraging, however, is Apple’s pivot to innovation with the release of the iPhone 17 series. Cameras have received a significant boost in the latest iPhone series, and the A19 chips used in new models are delivering a much better user experience. Additionally, the company has equipped the iPhone 17 series with “vapor chamber cooling” technology, which is expected to keep the device temperature in check even while using advanced AI features. Many users had previously complained of Apple iPhone devices heating uncontrollably while using advanced software features.

Apple’s renewed focus on innovation is a welcome sign for investors, as the company, without this focus, was expected to lose further market share in the all-important Mainland China market. Apple has also made an important decision to allow third-party app developers to access the core LLM that powers Apple Intelligence, which should enable them to add more AI features to their mobile applications.

What is the Target Price for AAPL?

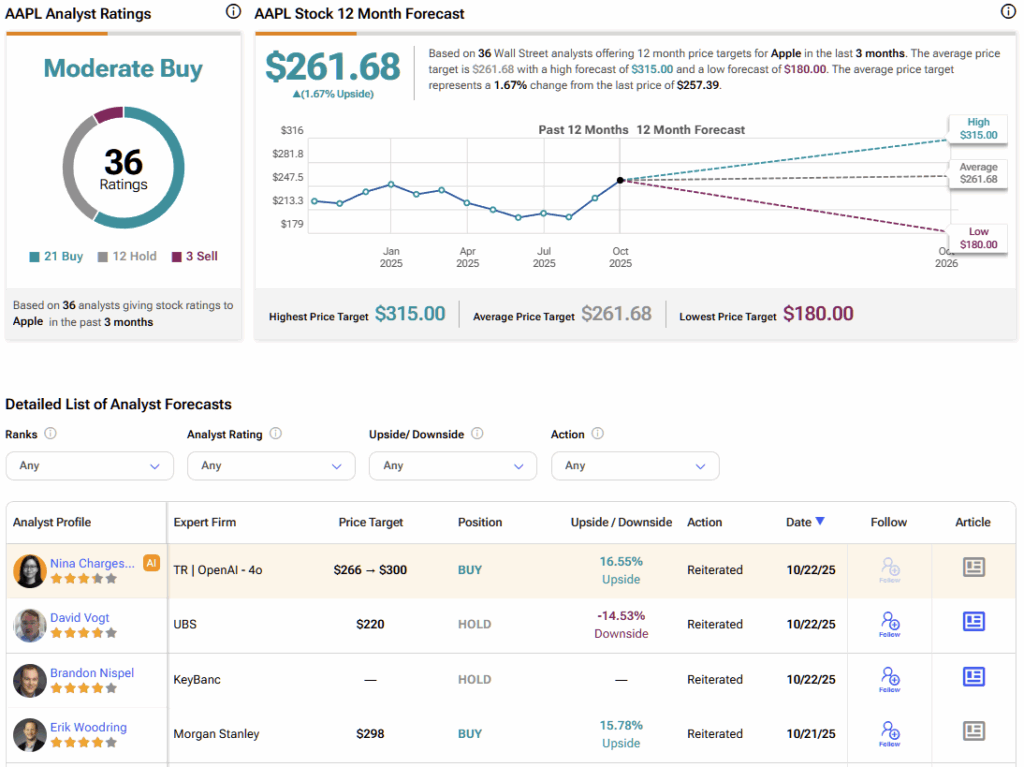

On Wall Street, AAPL stock carries a Moderate Buy consensus rating based on 21 Buy, 12 Hold, and three Sell ratings over the past three months. AAPL’s average stock price target of $261.68 implies approximately 2% upside potential over the next twelve months.

Wall Street analysts generally view Apple as fairly valued at current levels. While the iPhone 17 series has the potential to spark a major smartphone upgrade cycle—driven by its enhanced camera capabilities, lightweight design (notably the iPhone Air), and integrated AI features—I also consider Apple’s valuation to be complete at a forward P/E of 36x.

The company is currently trading at a premium compared to leading AI players such as Microsoft (MSFT) and Alphabet (GOOG), which, in my view, limits the margin of safety for investors, especially since Apple remains several years behind its big-tech peers in fully leveraging artificial intelligence.

iPhone Momentum Insufficient to Extend Upside

The iPhone 17 series is showing strong early momentum in the U.S. and China—two of Apple’s most vital markets. The company’s renewed commitment to innovation is a positive development, especially after recent years when limited advancements, particularly in AI integration, led to market share losses in China.

However, despite these encouraging signs, I believe Apple’s stock remains fairly valued, as it continues to trade at a premium to major tech peers that have made more substantial progress in adopting AI. Accordingly, I maintain a neutral outlook on Apple’s prospects based on its current valuation.