Apple (AAPL) is gearing up to enter a new market segment with its first-ever low-cost Mac laptop, expected to debut in the first half of 2026, according to Bloomberg. With this move, AAPL is aiming to attract students, casual users, and businesses who typically opt for Chromebooks or entry-level Windows PCs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move marks a major shift for the tech giant, which has long positioned its Mac lineup as a premium offering.

Importantly, the new device is seen as a direct challenge to Chromebooks, which dominate the education sector and low-cost market. By offering a Mac at a competitive price, Apple hopes to expand its ecosystem and win over users who might otherwise never consider a Mac.

What We Know So Far

The upcoming device, code-named J700, is currently in active testing and early production with Apple’s overseas suppliers. According to Bloomberg, the laptop will feature a lower-end LCD display that will be slightly smaller than the 13.6-inch screen of the current MacBook Air.

Also, the new laptop is expected to be powered by an A18 Pro chip, the same processor as the one in the iPhone 16 Pro. Initial testing has reportedly shown this chip to be more powerful than the M1 chip used in older MacBooks.

This approach allows Apple to keep costs down while still delivering a capable machine for everyday tasks such as web browsing, document editing, and light media work.

Apple reportedly plans to price the laptop “well under $1,000,” making it significantly more affordable than the current MacBook Air, which starts at $999.

Is AAPL Stock a Buy?

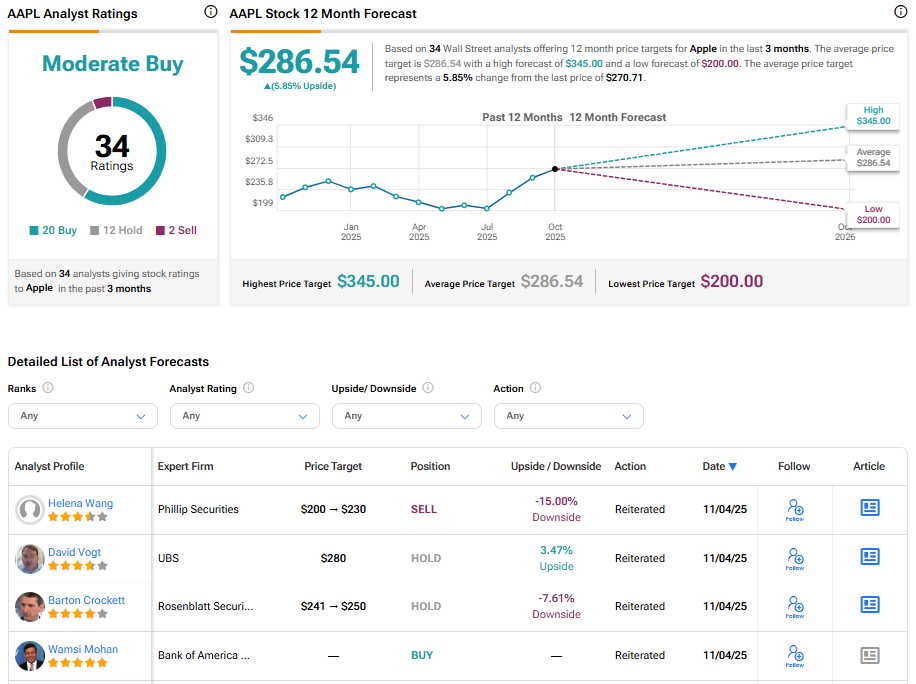

Turning to Wall Street, Apple stock has a Moderate Buy consensus rating based on 20 Buy, 12 Hold, and two Sell recommendations assigned in the last three months. The average AAPL price target of $286.54 implies 5.89% upside potential from current levels.