Asset management giant Apollo (APO) is preparing to roll out three new evergreen (no fixed maturity date) funds aimed at offering individual wealth investors in Europe broader access to the private markets. The launch of the funds comes as top asset managers are pushing for greater access to private markets for individual investors.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

New York-based Apollo announced the creation of the new funds on Wednesday, noting that it has secured permission from Luxembourg’s financial watchdog for the move. The funds are designed to be semi-liquid, meaning that they offer more redemption windows compared to Apollo’s earlier funds.

Apollo Taps Europe’s ELTIF 2.0 Regime

According to Apollo, the first fund is aimed at generating income for investors through top-priority asset-backed loans that will be issued to large-cap and upper middle-market companies in Europe. On the other hand, the second fund has a bigger aim and will seek to offer private credit to companies operating across various industries scattered around the world.

Similarly, the last fund will also invest in private companies globally, but it will be targeted at buying existing stakes or identifying co-investment opportunities. Apollo said the funds, which are to become available to investors over the coming months, will be floated under the European Long-Term Investment Funds (ELTIF) 2.0 regime.

The ELTIF 2.0 Regime is the revised version of the European Union’s regulatory framework that enables individual investors in the bloc and beyond to have greater access to private market investments. The framework also allows for a wider asset scope, removes the asset threshold for issuers, and enables more liquidity.

Asset Managers Race towards ELTIFs

Apollo’s new funds follow the rollout of a similar offering by Swedish asset manager EQT (EQT), which extended its private market investment platform to accommodate the ELTIF regime. Furthermore, German online bank Trade Republic recently tied up with Apollo and EQT (EQT) to offer fractional access to both companies’ private market products for its retail investors.

Again, Blackstone (BX) also recently launched a similar structure, offering individual investors in Europe and other regions access to private infrastructure investment. Not to be left out, British asset manager Schroders Capital (GB:SDR) also recently put forward the same product type.

These new offerings come as fundraising across all asset classes in the global private markets dropped to the lowest level since 2016, according to McKinsey. Dealmaking in 2024 was lukewarm, the management consulting firm noted in a report, even as the performance of public markets rose.

The drop was foreshadowed by rising geopolitical instability and volatile trade policies that created a challenging environment for asset managers and investors.

Is Apollo Stock a Good Buy?

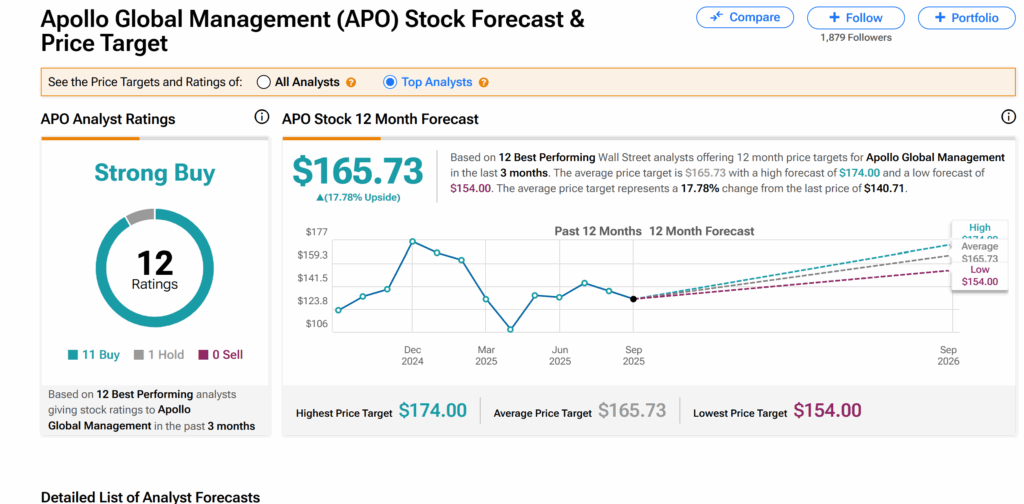

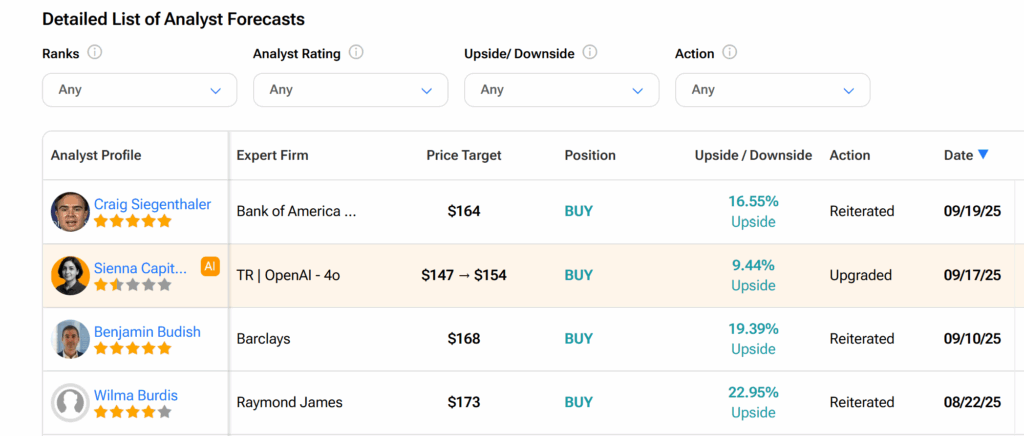

However, analysts on Wall Street are currently upbeat about Apollo’s shares. APO stock currently boasts a Strong Buy consensus recommendation, as seen on TipRanks, based on 11 Buys and one Hold assigned by Wall Street analysts over the past three months.

Furthermore, the average APO price target of $165.73 suggests an 18% growth potential from the current level.