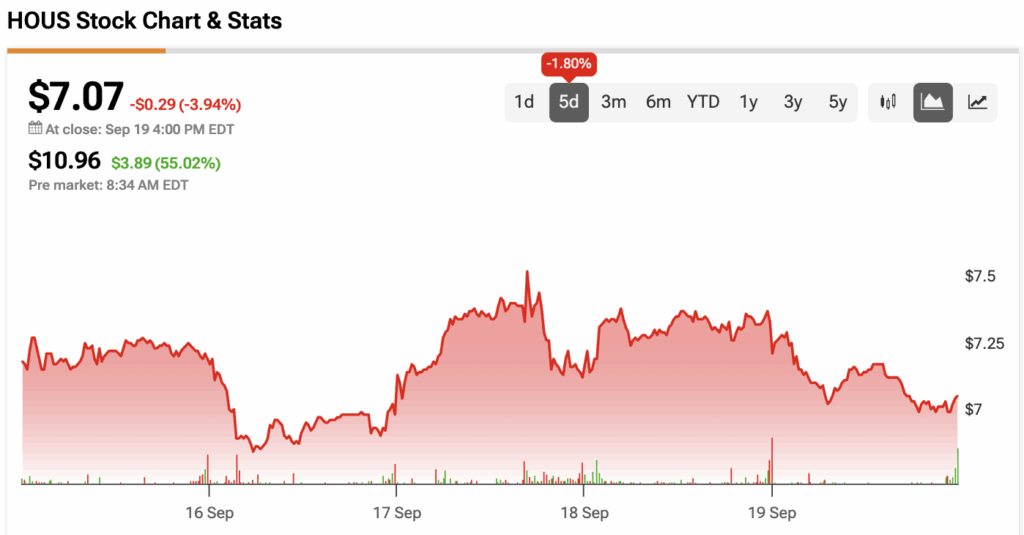

Anywhere Real Estate (HOUS), the owner of brands like Century 21 and Sotheby’s International Realty, shocked the market on Monday after Compass (COMP), the tech-driven residential brokerage, announced plans to acquire the company in an all-stock deal worth $1.46 billion. HOUS stock soared 55% in pre-market trading on the news.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The merger will create a $10 billion real estate platform, instantly combining Compass’ fast-growing digital tools with Anywhere’s household-name brokerages.

Compass Pays Up

Anywhere shareholders will receive 1.436 Compass shares for each share of Anywhere stock, translating to $13.01 a share. This marks a steep premium to Anywhere’s Friday close, which explains the massive premarket rally.

Anywhere stock surged 55% to $10.96 in premarket trading. Compass stock, on the other hand, slid 11.7% to $8.30 as investors weighed dilution and integration risks.

“Two of the Best Companies in Our Industry”

Compass CEO Robert Reffkin, who will continue leading the combined company, pitched the merger as a once-in-a-generation opportunity to reshape the industry.

“By bringing together two of the best companies in our industry, while preserving the unique independence of Anywhere’s leading brands, we now have the resources to build a place where real estate professionals can thrive for decades to come,” Reffkin said.

The merger is expected to close in the second half of 2026, pending regulatory approval.

Anywhere Becomes the Target

Earlier this year, Anywhere looked more like a buyer than a target. In May, the company reportedly made a play for luxury brokerage Douglas Elliman, though no deal materialized. Ironically, Anywhere is now the one getting scooped up.

Shares of Douglas Elliman rose about 6% Monday on the news, as investors speculated the Compass-Anywhere tie-up could ignite further consolidation across the real estate sector.

What Investors Should Note about this Acquisition

For Compass, the Anywhere acquisition is about scale. The company will command a platform worth $10 billion in enterprise value, combining Compass’ technology-driven brokerage model with Anywhere’s portfolio of traditional brands.

For Anywhere investors, it’s about survival. The company has faced stiff competition and a tough housing market in recent years. The Compass deal provides an exit at a premium and a shot at relevance in a market increasingly dominated by large, tech-enabled players.

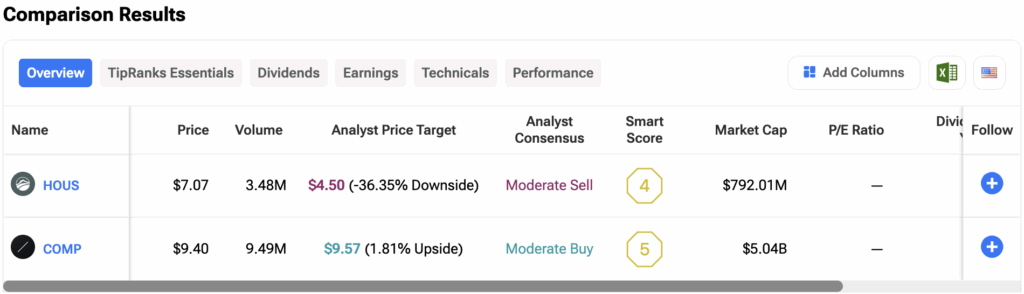

Investors can compare both stocks on various financial metrics and analyst ratings on the TipRanks Stocks Comparison Tool. Click on the image below to explore the tool.