Over the past 16 months, AI firm OpenAI (PC:OPAIQ) has spent about $6.4 billion in stock to acquire multiple startups, while its rival, Amazon-backed (AMZN) Anthropic (PC:ANTPQ), has made very few deals. However, that could soon change, according to The Information. Anthropic, now valued at $183 billion, has told investment bankers that it’s preparing to make acquisitions as it looks for targets that could improve its AI models, boost its technical capabilities, and expand its products beyond coding tools, which currently make up most of its revenue.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

It’s worth noting that Anthropic was founded in 2021 by former OpenAI employees and sells its Claude AI models to businesses through APIs and subscription plans that range from $17 to $150 per month. It serves clients like Anysphere, which builds developer tools, and Harvey, a legal-focused AI startup. The company reportedly brings in over $400 million in revenue each month. Given its success with coding assistants, Anthropic may expand into related tools, such as software testing and design, and is considering products tailored to industries like finance, healthcare, and cybersecurity.

To prepare for more acquisitions, Anthropic has been building a corporate development team led by Andrew Zloto, a former partner at SoftBank’s (SFTBY) Vision Fund. The team, which prefers smaller deals under $500 million, includes recent hires like James Black (formerly of IVP and Qatalyst Partners), Vu Bui (from Samsara (IOT) and Morgan Stanley (MS)), and Bryan Seethor (from TPG (TPG) and Morgan Stanley).

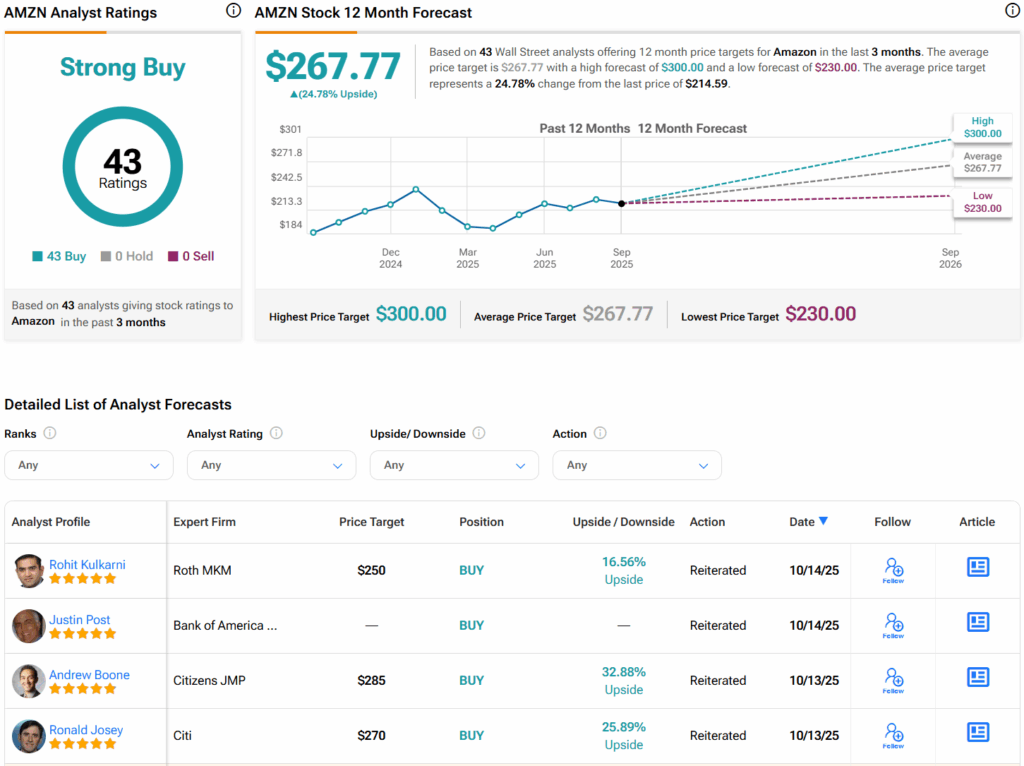

What Is the Price Target for AMZN Stock?

Turning to Wall Street, analysts have a Strong Buy consensus rating on Amazon stock based on 43 Buys assigned in the past three months. Furthermore, the average AMZN stock price target of $267.77 per share implies 24.8% upside potential from current levels.