Taiwan Semiconductor Manufacturing (NYSE:TSM) has made quite a splash lately, but there are some reports that the chip stock is not going to rest on its laurels. The latest word suggests that Taiwan Semiconductor is considering a new plant, and not in Taiwan. However, that wasn’t enough to help TSM stock as it’s down significantly in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The latest reports suggest that Taiwan Semiconductor is eyeing a new location in Japan for a third plant therein. The new plant in question would focus on three-nanometer chips and would likely be established in Kumamoto, a southern prefecture—kind of like a state or province—of Japan. Interestingly, Taiwan Semiconductor is already in the process of building one plant in Japan, which would focus on lower-end chips, and a second one is already in the planning stage. The third facility, therefore, would likely follow behind the completion of the second, though they may run concurrently.

TSM Continues to Route More Production Away from China’s Vicinity

If it seems like Taiwan Semiconductor has a lot less to do with Taiwan lately, it’s because of the neverending potential threat from the Chinese government. Taiwan has long been a sort of thorn in China’s collective side; Taiwan actually believes that it is China, while China agrees but believes that Taiwan is actually part of China. More specifically, a subordinate part. As a result, Taiwan Semiconductor might want—or even need—to route more production away from China’s general vicinity, especially if China turns ideology into action. Throw in interest in a major potential subsidy from Japan, and the notion only looks more reasonable.

Is Taiwan Semiconductor a Buy, Sell, or Hold?

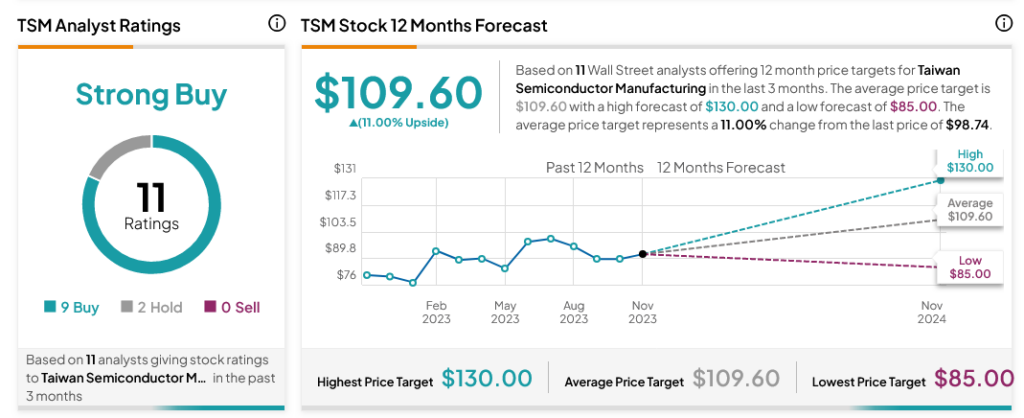

Turning to Wall Street, analysts have a Strong Buy consensus rating on TSM stock based on nine Buys and two Holds assigned in the past three months, as indicated by the graphic below. After a 21.54% rally in its share price over the past year, the average TSM price target of $109.60 per share implies 11% upside potential.