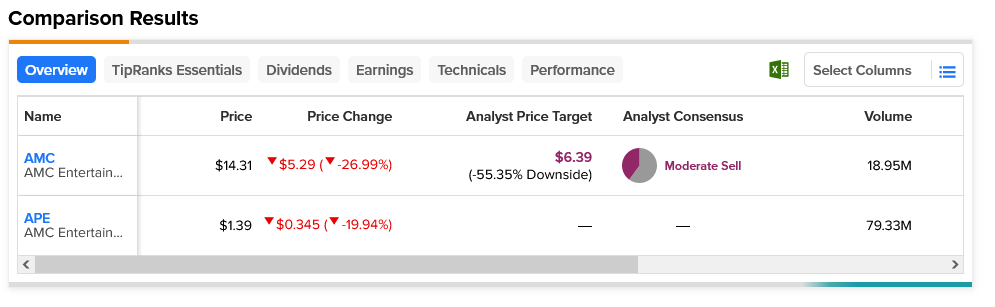

Though the ultimate realignment of AMC Entertainment (NYSE:AMC) stock and the AMC Preferred Equity (NYSE:APE) unit is about to finally happen, that hasn’t prevented the pricing drama from continuing. In fact, both AMC and APE took hits today, with AMC sliding just under 27% and APE losing just under 20% in Thursday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Earlier today, AMC pulled an unexpected maneuver and engaged in a 1-for-10 reverse stock split. That reduces the original count of AMC shares from 520 million to its new 52 million, and naturally, that sent prices soaring for at least a little while. And now, when Friday’s trading session begins, the APE will be no more, as it will be incorporated into the AMC Entertainment stock. The APEs will become AMC common stock at a rate of about 9.95 APEs to one AMC. But that also triggers one last key point: a litigation settlement payment that calls for an extra share for everyone who had at least 7.5 APE.

But in what may be an oddly good sign, Antara Capital, just days ago, pulled out of APE units altogether. It’s been selling off AMC stock in general since July and is now selling off APE units ahead of the merger. Under normal circumstances, this would sound like bad news, except for one thing: Antara Capital’s investment specialty is distressed assets. So for Antara to be selling off AMC suggests that it no longer regards AMC as a distressed asset.

While both AMC common stock and the APE unit were down in Thursday’s trading, only the AMC common stock has analyst coverage, and the coverage is not that great. Currently, AMC stock is a Moderate Sell by analyst reckoning, and its average price target of $6.39 means it comes with a 55.35% downside risk.