Love it or hate it, there’s been unexpected life in video game retailer GameStop (NYSE:GME), a stock that’s defied the odds before and may yet again. In fact, new reports suggest that GameStop could be in line for a big new rally, and investors are lining up. GameStop is up over 13% in Wednesday morning’s trading session thanks mostly to that surge.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

With GameStop’s next earnings report just a few days away, retail traders are piling back in, looking for a big win that will give the share price a goose and maybe even get it back up to the staggering levels it was at almost three years ago. Reports note that options volume is on the rise, as a December 8 strike call with $20 on the price pulled in over 20,000 interested buyers. The December 1 call, meanwhile, with a $13 strike price brought in 13,000. This already has Daniel Kirsch with Piper Sandler making references to the meme stock frenzy, albeit on a much smaller scale.

A Massive Jump, But Why?

Essentially, traders are looking for a surge of at least 50% in GME shares, fueled largely by an earnings report that hasn’t yet been released. They must be looking for something big to come out of that report, though given a recent report from Kotaku, that may be whistling past a graveyard. Kotaku writer Ethan Gach described an experience at GameStop featuring a favorite Black Friday tradition: picking up games on the cheap from GameStop. Gach describes how the experience at GameStop has been on the decline for years, including references to “meme stock shenanigans” and a “flailing C-suite.” But the topper comes when Gach described the panoply of customer disservices heaped upon the purchase of several games. Gach’s report does GameStop little justice here.

Is GameStop a Buy, Sell, or Hold?

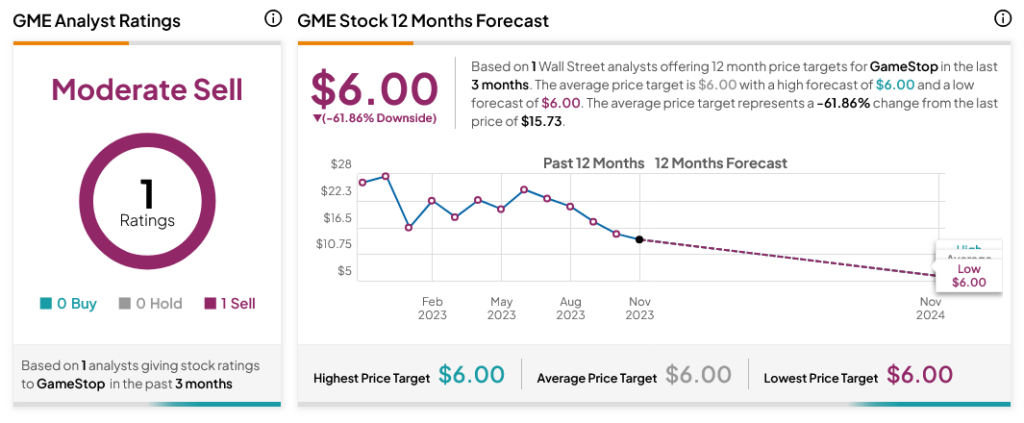

Turning to Wall Street, Michael Pachter is the lone analyst covering GME stock and has Sell rating. After a 48.53% loss in its share price over the past year, Pachter’s GME price target of $6 per share implies 61.86% downside risk.