With Dylan Mulvaney now spotted fleeing to Peru, and Anheuser-Busch Inbev (NYSE:BUD) trying frantically to win back customers, the news is still pretty troubling for the beer stock. In fact, the news is still bad enough to cause slightly losses in Anheuser-Busch today thanks to news about still-declining sales. Not that they had much farther to decline.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

The latest Nielsen data says that Bud Light sales dropped another 26.5%. That’s actually a faster pace of decline than the one seen back during June 17, which saw a drop of 25.9%. Bud Light volumes did no better, down 29.7% against the previous week’s loss of 29.3%. Anheuser-Busch did almost everything it could to pull in customers. It offered extensive discounts—at one point, it was basically giving away cases of Bud Light thanks to the rebates involved—and adjusted its marketing on several occasions.

All of which went over like a lead balloon with an unforgiving public, and nowhere was the extent of this chaos better seen than in Sturgis, South Dakota. The town known—or perhaps infamous—for its annual motorcycle rally featured a Budweiser tent…that was virtually empty. Video of motorcycles racing by the empty tent shocked many onlookers, and it only got worse from there. An attempt to win back favor, featuring cans with camouflage designs, fell flat with onlookers. One online response called for Anheuser-Busch to “camouflage their beer with new brand names” instead.

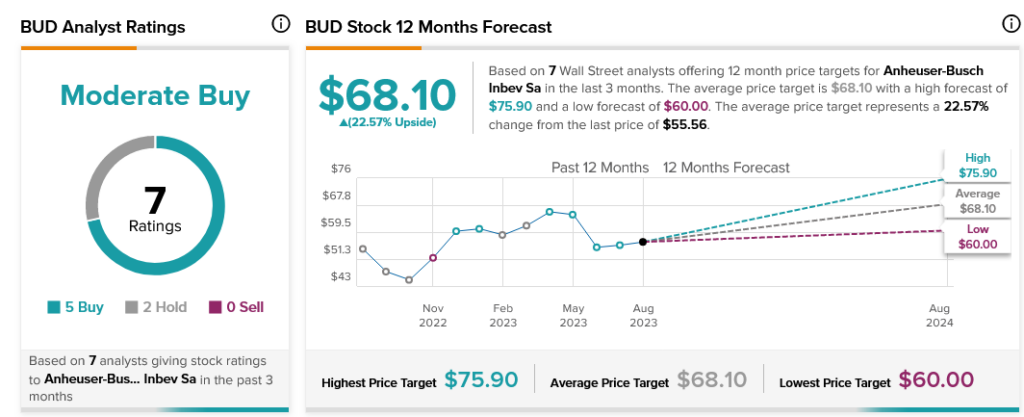

Despite this latest debacle, analysts are still pretty soundly on Anheuser-Busch’s side. Anheuser-Busch stock is currently considered a Moderate Buy by analysts, with five Buy ratings and two Hold. Further, Anheuser-Busch stock also comes with a 22.57% upside potential thanks to its average price target of $68.10 per share.