For a while, all eyes were on chip stock ARM Holdings (NASDAQ:ARM) as it started up in the middle of a strange new environment. While the chip shortage has mostly been addressed, issues of demand destruction are starting up and putting chips in a surprisingly uncertain state. Now, analysts are weighing in, and while they’re generally positive, that wasn’t enough to stop a fractional downturn in Monday morning’s trading.

Pick the best stocks and maximize your portfolio:

- Discover top-rated stocks from highly ranked analysts with Analyst Top Stocks!

- Easily identify outperforming stocks and invest smarter with Top Smart Score Stocks

JPMorgan kicked things off for ARM Holdings in a very positive way, as it started up coverage with an Overweight rating and a price target of $70 per share. Word from JPMorgan analyst Harlan Sur was that ARM has nearly all of the smartphone market sewn up as both Apple and Android phones turn to ARM architecture. Moreover, ARM Holdings is working to build more paths outward, picking up new intellectual property to get into things like networking functions and memory. That makes a good thing even better and improves the way forward.

That wasn’t the only upshot for ARM, either; Goldman Sachs also came out with a Buy rating as well. ARM’s plans to build into cloud markets, as well as automotive, came as welcome news to analysts and were enough to spur interest. Not everyone was so optimistic, however; three analysts put Hold ratings on ARM shares, while another assigned a Strong Sell. This was mostly due to ARM’s current focus on the smartphone market, which is in open decline as consumers pull in their wallets ahead of a likely recession.

What is the Expected Price of ARM?

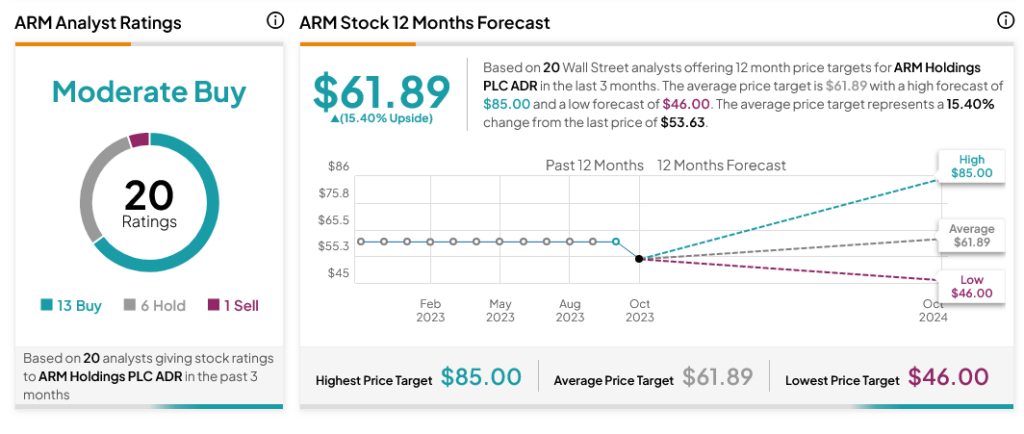

ARM Holdings, meanwhile, is drawing in quite a bit of interest. With 13 Buy ratings, six Holds, and one Sell, ARM Holdings stock is currently consensus-rated as a Moderate Buy. Further, with an average price target of $61.89, ARM Holdings stock offers investors 15.4% upside potential.